The Alpha:

- On January 18, Yuga Labs launched Dookey Sprint, an interactive minting expertise playable till February 6.

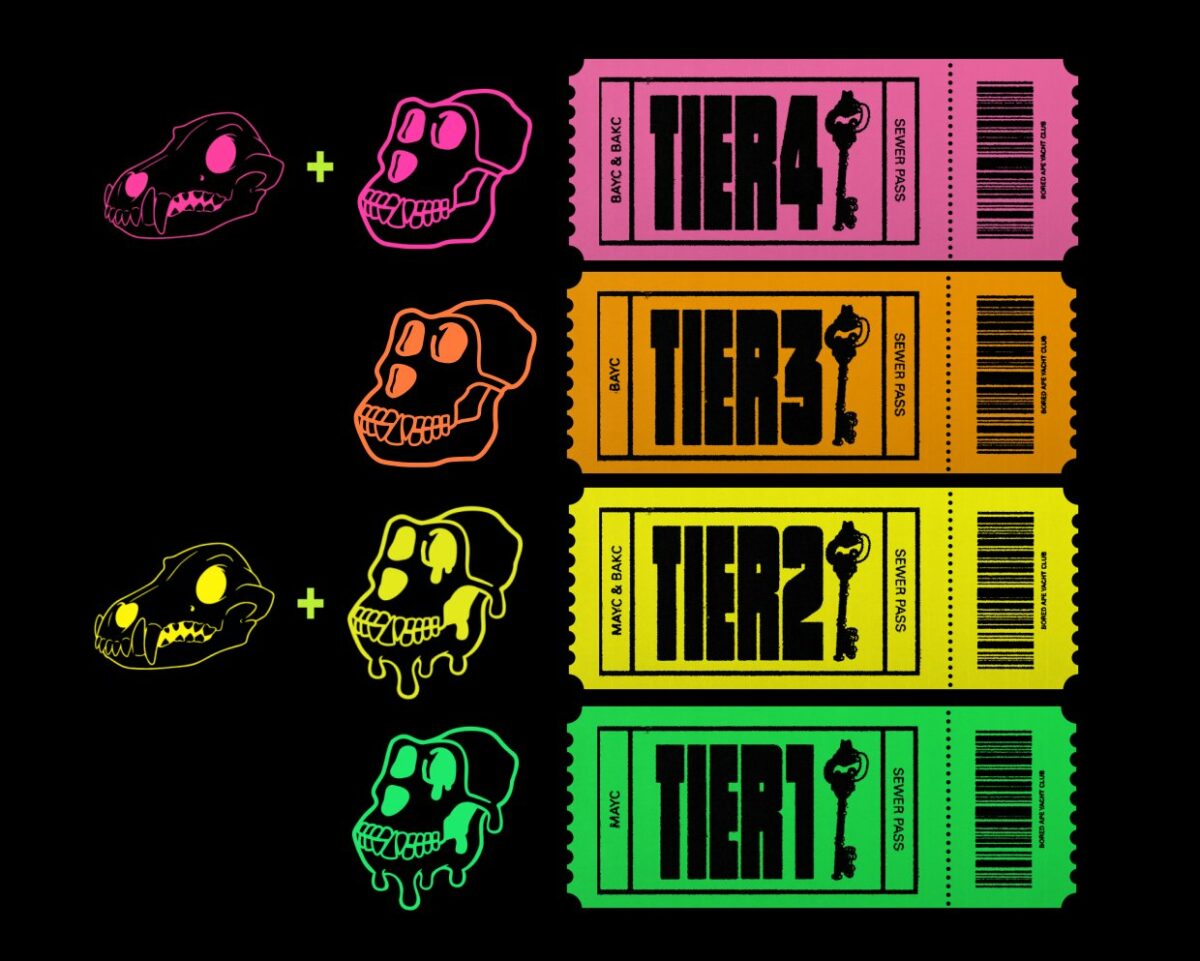

- Customers will need to have a Sewer Cross of their crypto pockets to play the sport. These passes had been initially airdropped to BAYC and MAYC NFT holders without spending a dime and have since began showing on secondary NFT marketplaces, as introduced by Yuga Labs in a Tweet.

- Public demand for Sewer Passes has reached a fever pitch since they first turned out there. Simply three days since showing on OpenSea, Sewer Passes have accrued a buying and selling quantity of over 13,000 ETH — greater than $20 million per latest greenback valuations of ETH.

Why it issues

After gracing the NFT area with the Bored Ape Yacht Membership in early 2021, Yuga Labs established itself as the dominant participant within the ecosystem (and the identify these outdoors Web3’s partitions are probably to have heard of when somebody brings up NFTs). After releasing follow-up collections — together with the Mutant Ape Yacht Membership and the Bored Ape Kennel Membership — and teasing the NFT ecosystem with the Otherside metaverse, many questioned how the BAYC universe would transfer ahead as 2023 arched into view.

In January, the corporate introduced the Sewer Cross mint, an NFT airdropped to BAYC/MAYC holders and made out there on the secondary market. The NFT would grant holders entry to a skill-based sport known as Dookey Sprint that’s set within the sewers of the Bored Ape Yacht Membership. The information put the NFT group on discover, and after delaying the Sewer Cross mint by a day, Yuga dropped the gathering to a lot anticipation.

The mint was at all times going to be massive, however the Sewer Cross assortment has since put up some spectacular numbers, seeing over 13,000 ETH ($20 million) in quantity within the three days because it dropped. That quantity will doubtless proceed to skyrocket (leaping up one other 30 ETH through the writing of this story). It’s a transparent indication that the NFT powerhouse that helped solidify the 2021 bull run and put NFTs on a broader cultural map is able to proceed its reign, irrespective of the bear market circumstances that bookend it.

What’s subsequent

Yuga Labs has additionally used the Sewer Cross as a chance to make a robust assertion. Having made it no secret the place the workforce stands on the controversy, the group has blocked secondary marketplaces that don’t totally implement creator royalties from promoting the tokens on their platforms.

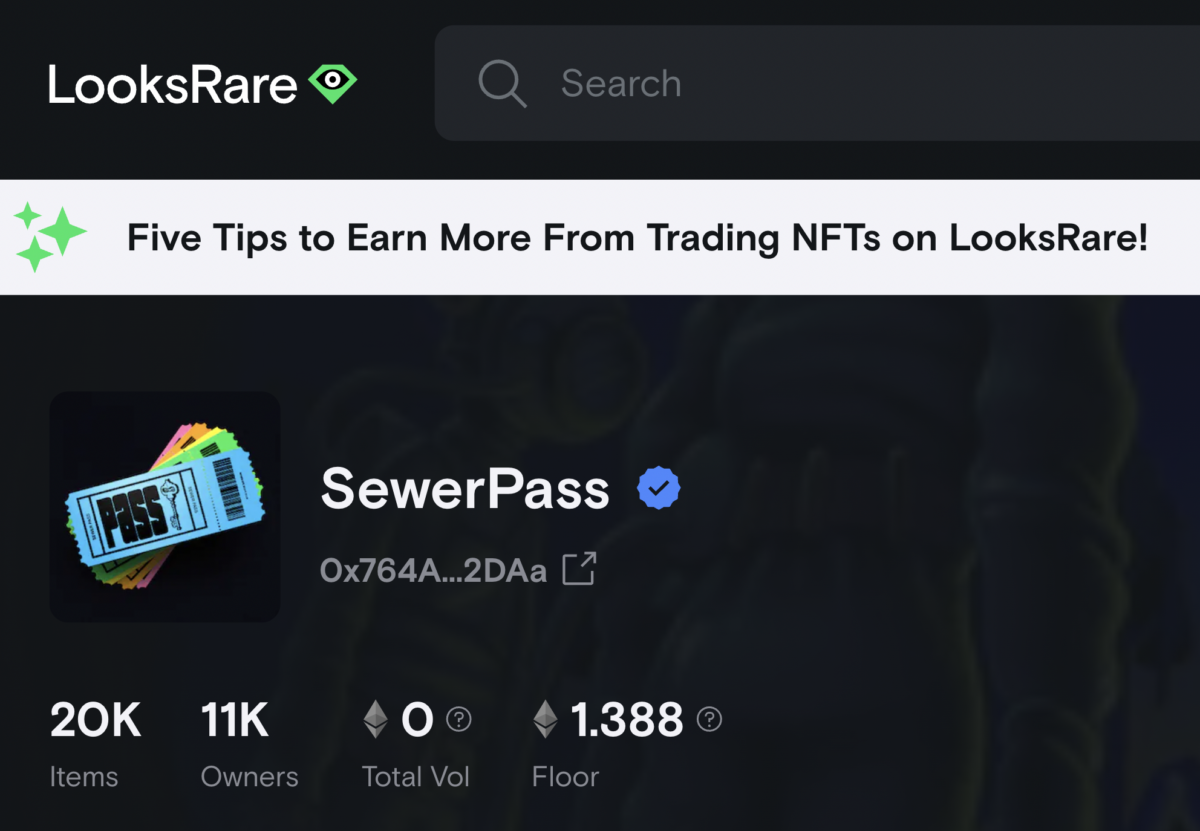

OpenSea and X2Y2 have seen buying and selling quantity soar in the previous couple of days, whereas platforms like LooksRare, Blur, and NFTX can’t transact the NFTs, a Yuga Labs consultant confirmed to Decrypt. Sudoswap, one other buying and selling platform marketed for its zero-royalty stance, is equally blocked from buying and selling the NFTs. Nonetheless, they might be circumventing the measure, because the platform exhibits over 569 ETH in buying and selling quantity on its Sewer Cross web page.

OpenSea reinvigorated the royalties debate final fall when it floated after which deserted its determination to modify to zero-royalty-enforcement for its present collections. Since then, NFT tasks utilizing the platform have taken benefit of its Operator Filter Registry function, OpenSea’s first on-chain enforcement software.

However wait! There’s extra: