Shopper blockchain and funding outfit Animoca Manufacturers has determined to not IPO however as an alternative to get an inventory on the US Nasdaq alternate by way of a reverse merger with fintech group Currenc Group Inc (CURR).

The proposal, which is being mentioned by way of a three-month exclusivity interval, would see present Currenc shareholders getting 5% of the brand new firm known as Animoca Manufacturers, with present Animoca shareholders taking the remaining 95%.

Most of Currenc’s present enterprise exercise involving AI-powered options for monetary establishments and a digital remittance platform will probably be spun of as a separate firm.

Based mostly on Currenc’s market cap previous to the announcement, the newly listed Animoca Manufacturers can be valued round $2.4 billion.

It ended 2024 with $4.3 billion in whole property.

Each events count on the deal to be agreed throughout 2025, topic to shareholder and regulatory approvals and different customary circumstances.

“The proposed merger of Animoca Brands and Currenc will result in the world’s first publicly-listed, diversified digital assets conglomerate, giving investors on Nasdaq direct access to the growth potential of the trillion-dollar altcoin digital economy through a single, diversified vehicle spanning DeFi, AI, NFTs, gaming, and DeSci,” commented Animoca Model’s govt chairman Yat Siu.

“We believe that this proposed transaction would usher in a new asset class that should position investors at the forefront of one of the greatest opportunities of our generation.”

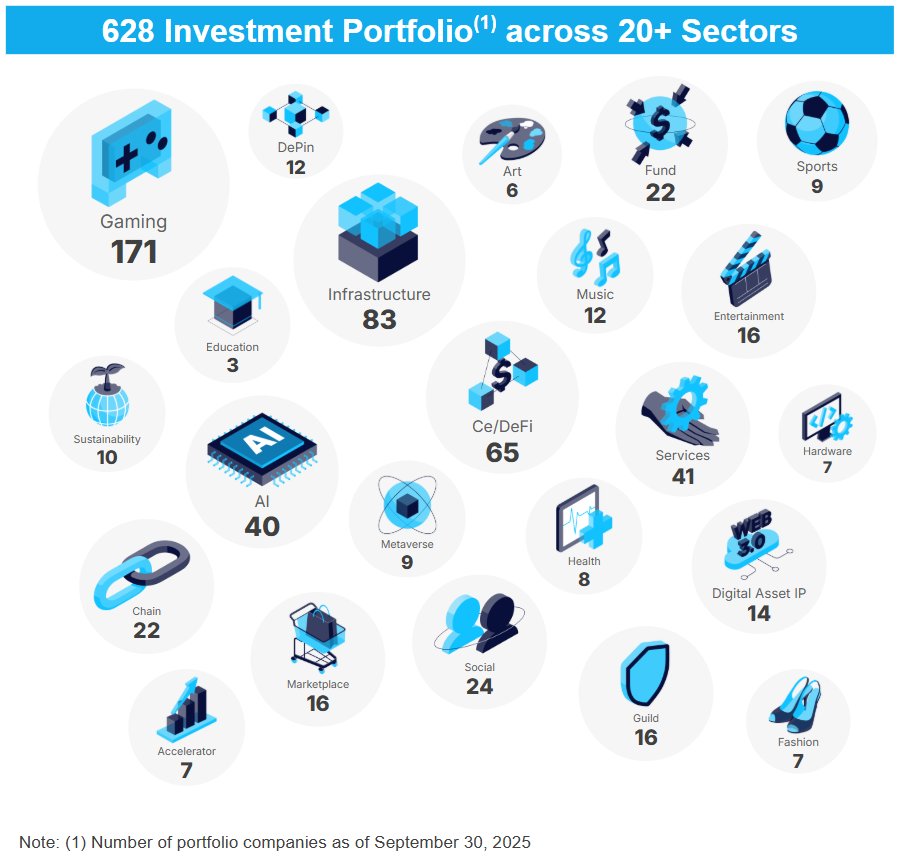

Animoca Manufacturers claims it now has 628 investments in blockchain firms and tasks.

You possibly can learn Yat Siu’s chairman letter speaking concerning the proposed deal right here.