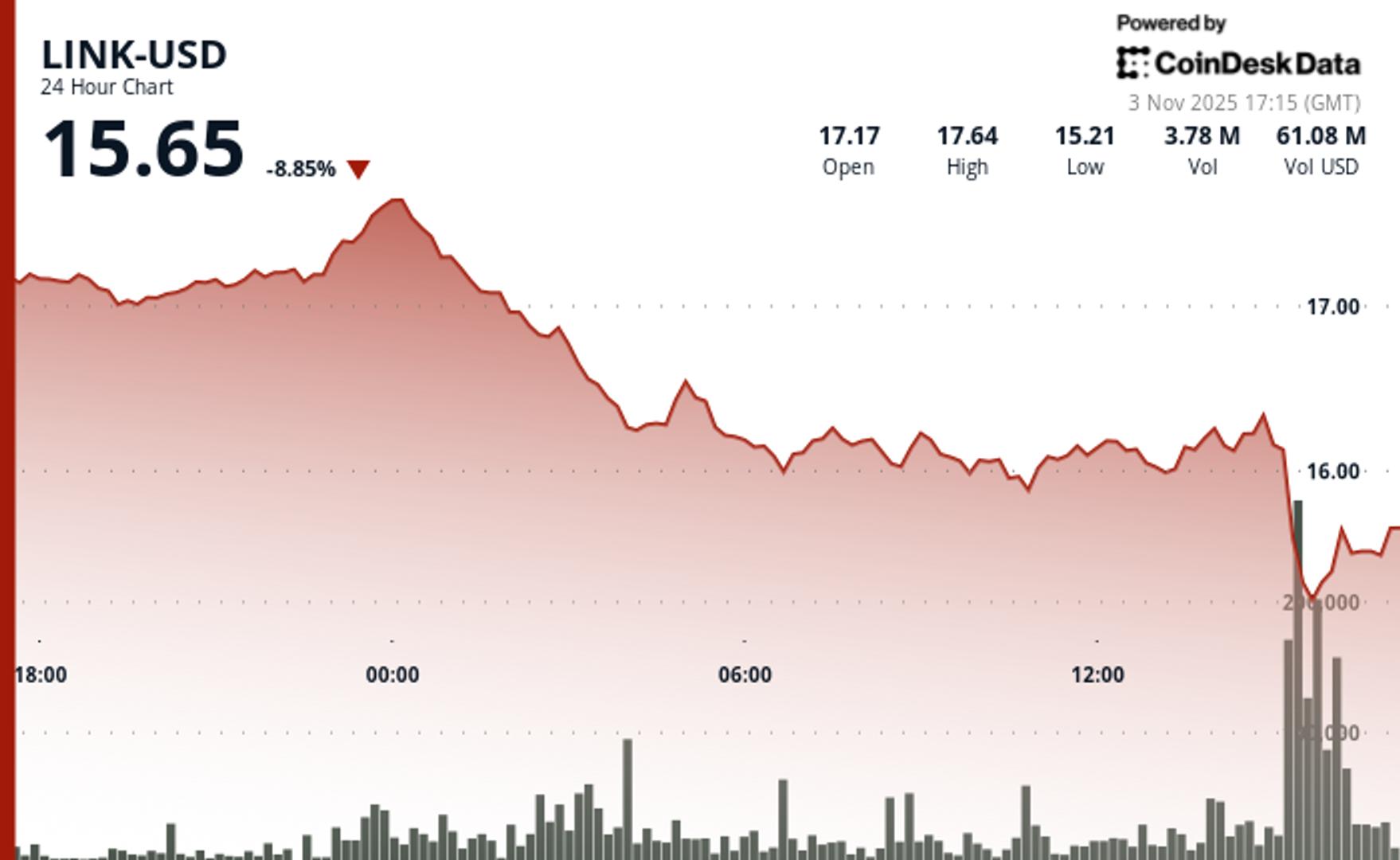

Chainlink’s LINK token fell 10% on Monday, plunging to its weakest worth because the October 10 flash crash breaking down key assist ranges.

Buying and selling exercise spiked 674% above the 24-hour common on the peak of the breakdown, with over 12 million LINK altering fingers because the token dropped from $16.21 to $15.02 in beneath half-hour, CoinDesk Analysis’s technical mannequin stated.

The token underperformed the CoinDesk 5 index by greater than 5.8%, signaling technical weak spot amid heavy quantity.

The CoinDesk Analysis mannequin pointed to a failed breakout earlier within the week and lack of contemporary catalysts as causes for the transfer. LINK now faces crucial assist round $15.25, with technical draw back threat towards $14.50 if patrons fail to stabilize the present vary.

Chainlink information

The selloff got here as Chainlink unveiled “Rewards Season 1,” a brand new incentive program launching on November 11. The initiative will permit eligible LINK stakers to earn token rewards from 9 collaborating Chainlink BUILD initiatives, together with Dolomite, House and Time, Truflation-linked Truf Community and others, the Monday weblog submit stated.

Contributors can earn Cubes — non-transferable reward factors — based mostly on prior staking exercise, which they’ll allocate to initiatives of their selection earlier than rewards start unlocking in mid-December.

Key technical ranges LINK merchants ought to watch

- Assist/Resistance: Instant assist at $15.25–15.30; resistance sits at $17.66

- Quantity Evaluation: Quantity peaked at 12.4 million tokens, up 674% from the each day common.

- Chart Patterns: Breakdown confirmed with decrease highs following failed breakout.

- Targets & Danger/Reward: If $16 fails to carry, draw back extends to $14.50; restoration faces sturdy resistance at $20.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.