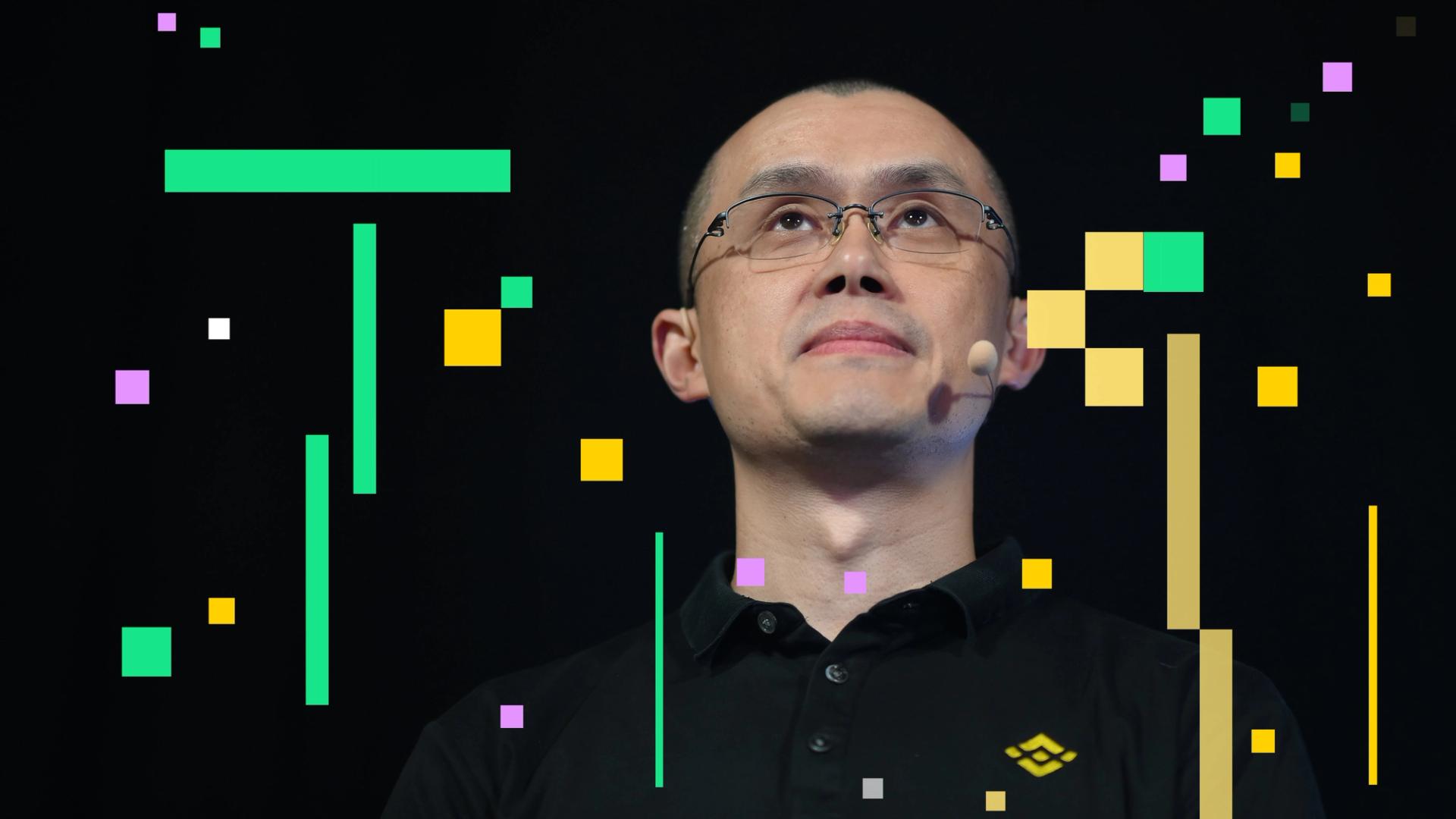

DEX token ASTER surged as Binance founder Changpeng Zhao (CZ) bought roughly 2 million of them, sending a wave of speculative demand throughout the market.

Traders interpreted the acquisition as a sign of confidence from considered one of crypto’s most influential figures, and ASTER climbed practically 20% in response.

The underlying undertaking behind ASTER is a rebranded by-product platform that merged from older tokens (together with APX) and relaunched with a token-generation occasion in September 2025. ASTER’s max provide is 8 billion tokens, with over half allotted to group incentives comparable to airdrops and strategic distribution.

The platform packages itself as a hybrid decentralized change providing perpetuals and spot buying and selling throughout a number of chains, with options like hidden orders and excessive leverage.

CZ’s public endorsement — the place he described ASTER’s launch as a “strong start” — added gas to the rally. On-chain knowledge cited by analysts present ASTER’s pockets amassed massive sums of USDT and have become one of many largest on BNB Chain outdoors of Binance itself.

Though the bounce is actual, the danger of retreat is equally tangible. Excessive token provide, intense competitors (particularly from rivals like HYPE), and a narrative-heavy enhance moderately than clear, sustained basic breakthroughs imply merchants ought to stay vigilant of value spikes.