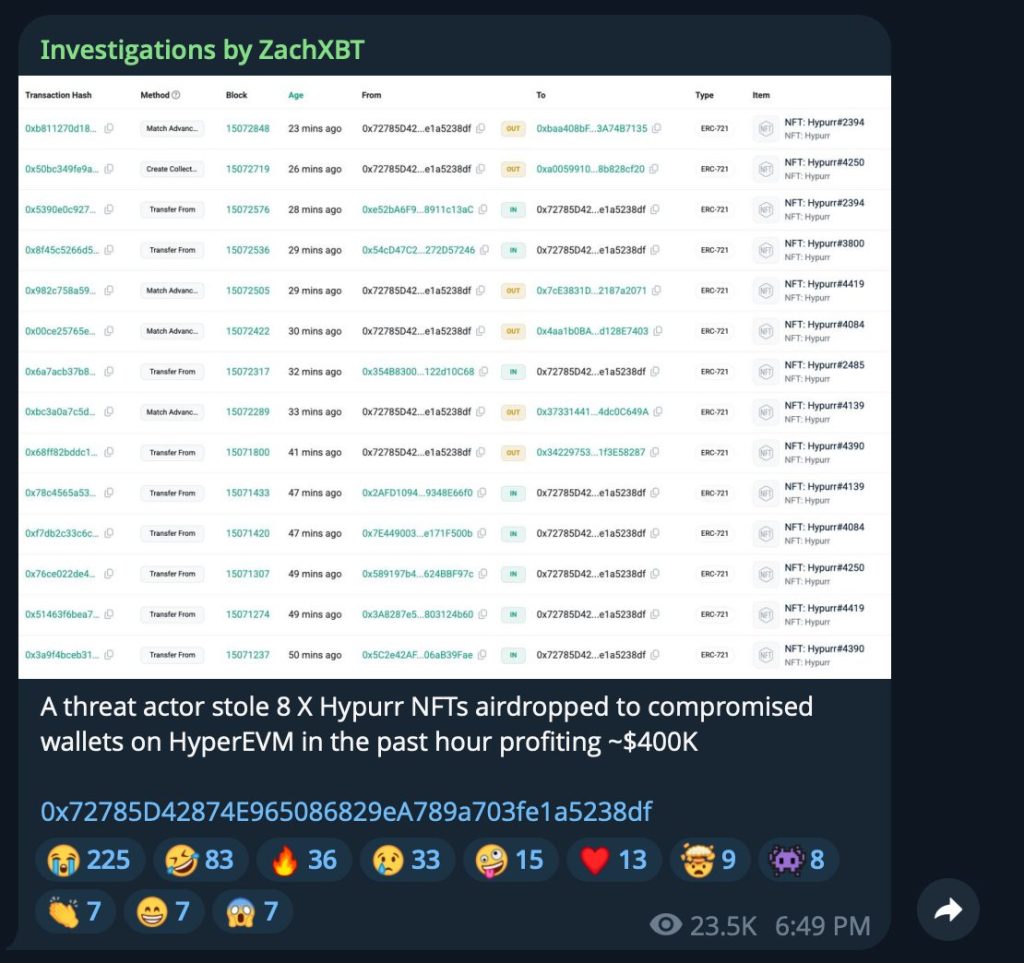

A risk actor stole eight Hypurr NFTs value roughly $400,000 inside hours of the gathering’s launch by compromising wallets that acquired the airdropped tokens on Hyperliquid’s HyperEVM layer.

Blockchain investigator ZachXBT first reported the delicate theft concentrating on early Genesis Occasion contributors who had opted to obtain the free digital collectibles.

The Hyper Basis distributed 4,600 distinctive cat-themed NFTs on September 28 to reward early supporters from the November 2024 Genesis Occasion.

The gathering instantly achieved a ground worth of $68,900, with whole buying and selling quantity reaching $45 million inside 24 hours on OpenSea. On the time of writing, the ground worth has surpassed $70K.

The costliest sale concerned Hypurr #21, which featured uncommon “Knight Ghost Armor” traits, promoting for 9,999 HYPE tokens, value roughly $470,000.

Some NFTs had traded over-the-counter for $88,000 earlier than the official launch by DripTrade’s collateralized pre-sale system.

The theft compounds safety issues plaguing Hyperliquid’s ecosystem following the $773,000 HyperDrive exploit and $3.6 million HyperVault rug pull inside the identical week.

The speedy succession of assaults has intensified scrutiny of safety practices throughout initiatives constructing on the decentralized alternate platform.

Digital Cats Command Six-Determine Prices Regardless of International Financial Pressures

The Hypurr assortment options generative artwork depicting cartoon cats with varied traits, together with sun shades, wizard robes, and armor components.

Distribution allotted 4,313 NFTs to Genesis Occasion contributors, 144 to the Hyper Basis, and 143 to core contributors, together with builders and artists.

In keeping with OpenSea knowledge, over 1.3 million HYPE tokens have been traded previously 24 hours, equal to $61 million at present costs.

The gathering maintained 92.8% of provide held by 4,270 distinctive house owners.

Group reactions diverse extensively, with some celebrating life-changing windfalls whereas others criticized the wealth disparity.

Inventive director Alex Obymuralex praised the Hypurr design language as “timeless” reasonably than trend-driven, noting the gathering’s easy types and saturated colours decrease intimidation boundaries for mainstream adoption.

He argued that recognizable silhouettes and joyful palettes create lasting model fairness past hypothesis cycles.

Early adopters who participated in November’s Genesis Occasion acquired the NFTs without charge past their preliminary platform engagement.

The occasion centered on the launch of Hyperliquid’s native HYPE token and HyperEVM programmability layer.

Notably, DripTrade’s over-the-counter system enabled pre-launch buying and selling by collateralized agreements requiring sellers to satisfy transactions inside seven days of receiving NFTs or forfeit deposited safety.

This mechanism allowed worth discovery even earlier than official distribution.

Safety Breaches Threaten Ecosystem Credibility

The Hypurr NFT theft follows three main safety incidents concentrating on Hyperliquid initiatives inside one week.

HyperDrive DeFi misplaced $773,000 by router contract vulnerabilities that enabled arbitrary operate calls, whereas HyperVault builders executed a $3.6 million exit rip-off after ignoring group warnings about fabricated audit claims.

Earlier exploits embody the March JELLY token manipulation, which value $13.5 million, and the “ETH 50x Big Guy” dealer, who netted a $1.8 million revenue whereas inflicting $4 million in vault losses.

This incident prompted a discount in most leverage limits from 40x to 25x for main cryptocurrencies.

Competitors intensifies as ASTER DEX processes over $13 billion in day by day perpetual futures quantity, in comparison with Hyperliquid’s decreased exercise.

ASTER’s Belief Pockets integration gives 100 million customers with direct entry to perpetual contracts, difficult Hyperliquid’s market dominance.

Arthur Hayes exited his complete HYPE place with a $823,000 revenue, citing the large token unlocks value $11.9 billion that have been set to start out on November 29.

He not too long ago polled followers about re-entering after HYPE dropped 23% weekly to $35.50.

Nonetheless, group members have proposed blacklisting Hayes from buying HYPE, with some labeling his trades because the “ultimate sell signal.”

Regardless of safety challenges, Hyperliquid launched its USDH stablecoin, producing $2.2 million in early quantity, whereas Native Markets secured the issuance mandate by a aggressive governance voting course of.

The platform additionally activated HYPE/USDH spot buying and selling following Native Markets’ dedication to stake 200,000 tokens for a interval of three years.

HYPE traded up 4.65% following the Hypurr launch, reaching $47.14 as group enthusiasm quickly overshadowed ongoing safety issues and competitors threats throughout the broader ecosystem.

The publish Hyperliquid’s Hypurr NFTs Hit $76K Floor Price, But Hacker Steals 8 for $400K Profit appeared first on Cryptonews.

HyperDrive DeFi loses $773,000 in router vulnerability exploit as second main Hyperliquid ecosystem breach in 72 hours.

HyperDrive DeFi loses $773,000 in router vulnerability exploit as second main Hyperliquid ecosystem breach in 72 hours.