Key Takeaways:

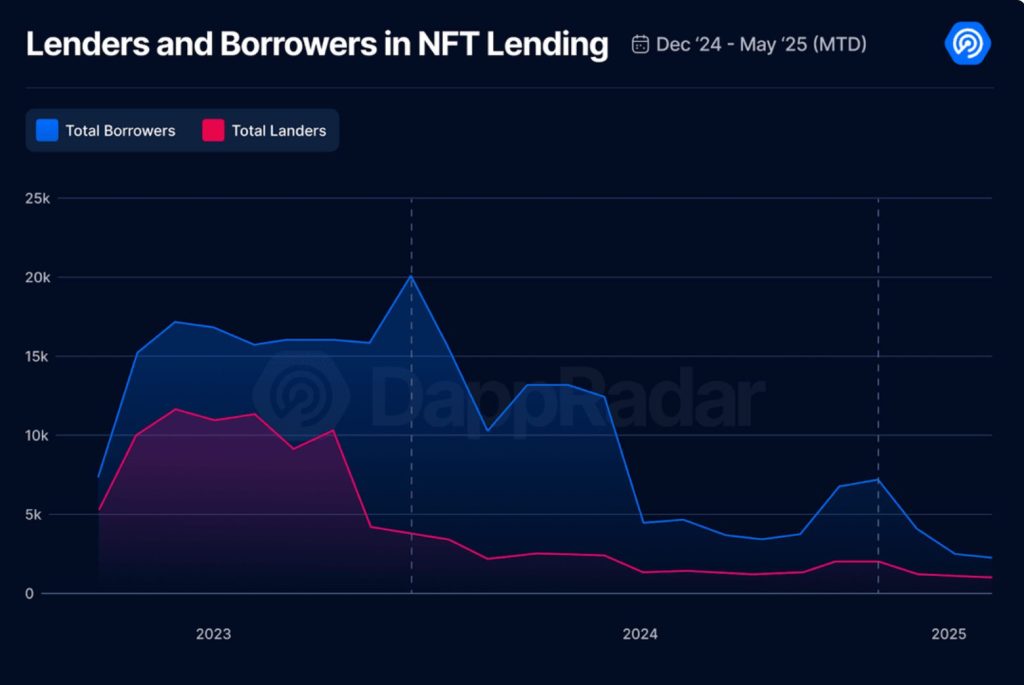

- NFT lending quantity has plunged 97% from its 2024 peak, with debtors and lenders retreating sharply.

- GONDI now dominates the sector, overtaking Mix by providing longer-term, steady lending backed by artwork NFTs.

- For revival, the market wants real-world use instances and utility-driven improvements past protocol tweaks.

The NFT lending market has tumbled by 97% from its January 2024 peak, dropping from almost $1 billion in month-to-month quantity to only over $50 million in Could 2025.

As soon as a booming sector for unlocking liquidity, NFT lending is now in freefall as person exercise, mortgage sizes, and confidence vanish, based on a latest report by DappRadar.

The decline is broad. Debtors have dropped by 90%, and lender participation has fallen 78% since January final 12 months. Common mortgage dimension has shrunk from $22,000 in 2022 to $4,000 this Could — a 71% year-over-year lower. T

GONDI Overtakes Blur to Lead NFT Lending Market

The shift in platform dominance underscores the change in person conduct. GONDI now leads the sector with 54.2% of complete excellent quantity, overtaking Blur, whose Mix protocol as soon as managed over 96% of the market.

Mix’s rise was fueled by airdrop incentives and aggressive flipping, however that mannequin hasn’t survived the bear market.

GONDI, in contrast, has gained floor by catering to customers searching for longer-term, extra steady lending choices.

Collateral preferences have modified too. On conventional platforms like NFTfi and Arcade, Pudgy Penguins dominate, producing over $203 million in loans since January.

Azuki and Bored Apes comply with, however volatility has damage their lending reliability. In the meantime, on GONDI, the main target has shifted to artwork NFTs and 1/1 items.

CryptoPunks prepared the ground with over $21 million in energetic loans, adopted by high-end generative collections like Fidenzas and Beeple works.

Loan durations are additionally tightening. The typical in Could 2025 stood at 31 days, down from round 40 days in 2023.

The shorter phrases replicate a extra cautious and tactical strategy by debtors who’re now not betting on huge swings.

Eight protocols nonetheless maintain significant market share, however solely two are dominant.

Behind GONDI and Mix are NFTfi (7%), Arcade (4.7%), and JPEG’d (2%). Metastreet, Zharta, and X2Y2 path far behind with sub-1% shares. The sphere has thinned considerably from its peak.

NFT Lending Isn’t Useless

DappRadar stated the NFT lending market gained’t bounce again on art-backed loans and protocol tweaks alone.

To maneuver from speculative area of interest to monetary utility, the sector should embrace new use instances — from tokenized real-world belongings and intent-based borrowing to credit-scored lending fashions.

“If the next wave builds on utility, culture, and better design, NFT lending might just find its second wind — one built to last,” it stated.

Notably, in latest months, DraftKings, GameStop, and Bybit have all shut down their NFT platforms, with Bybit citing a steep decline in buying and selling volumes in its April 8 announcement.

X2Y2 has additionally revealed plans to wind down its market by April 30 to pivot towards synthetic intelligence.

Again in March, Starbucks, the famend multinational espresso chain, determined to terminate its NFT rewards program.

The publish NFT Lending Market Crashes 97% as Users and Loan Sizes Plummet appeared first on Cryptonews.