An organization specializing in smartwatch face designs offered via non-fungible tokens (NFTs) has filed a lawsuit towards luxurious items big LVMH, alleging patent infringement.

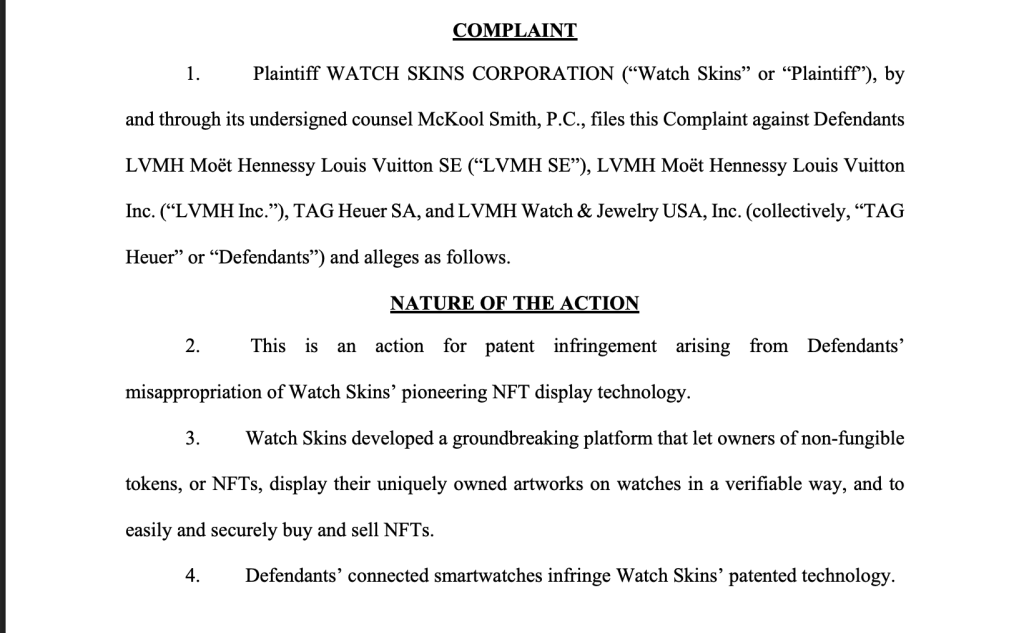

Watch Skins Company, the plaintiff, submitted its criticism to a federal courtroom in Texas on March 10, accusing LVMH of unlawfully utilizing its patented NFT show know-how.

The corporate claims to carry a number of patents for a system that permits smartwatches to show verified NFT artworks.

Watch Skins Accuses TAG Heuer of Misusing NFT Tech

Based on Watch Skins, LVMH’s watch model, TAG Heuer, together with different merchandise beneath the conglomerate’s umbrella, allegedly misused its proprietary know-how.

The corporate pointed to a few particular patents: one for verifying NFT possession earlier than show, one other for authenticating NFTs via a blockchain pockets, and a 3rd for retrieving and displaying customized watch faces primarily based on NFT possession.

The lawsuit additional alleges that TAG Heuer actively inspired clients to infringe on these patents by offering directions on how one can make the most of its NFT show function.

The criticism states that the smartwatch “connects to a user’s crypto wallet to guarantee authenticity” earlier than permitting NFTs to be displayed.

LVMH, a multinational holding firm, owns an intensive portfolio of luxurious manufacturers, together with Louis Vuitton, Givenchy, Tiffany, Christian Dior, and Hennessy.

TAG Heuer’s involvement in NFT integration has beforehand been highlighted as a part of LVMH’s broader push into digital property.

Watch Skins is searching for a jury trial, monetary compensation for misplaced income and royalties, and a courtroom injunction to cease LVMH from additional utilizing its patented know-how.

The corporate first launched its blockchain-powered NFT watch face market on the Shopper Electronics Present in Las Vegas in 2020.

By means of a cell app, it permits customers to purchase formally licensed smartwatch faces from varied manufacturers.

NFT Buying and selling Volumes Plunge Over 60% in February

As reported, NFT buying and selling volumes plummeted by greater than 60% in February, persevering with a downward development that started in early 2024.

Based on DappRadar analyst Sara Gherghelas, NFT buying and selling volumes reached $1.36 billion in December however dropped 26% in January earlier than plunging one other 50% in February.

“While NFTs had been showing signs of a comeback in recent months, their momentum has slowed since the start of the year,” she famous in a March 6 business report.

Notably, the NFT market closed 2024 on a optimistic observe with annual gross sales surpassing $8.83 billion, a 1.1% enhance from 2023’s $8.7 billion, in accordance with CryptoSlam information.

Ethereum and Bitcoin led the market, every producing $3.1 billion in gross sales, adopted by Solana with $1.4 billion.

In complete NFT gross sales, Ethereum stays dominant with $44.9 billion in all-time gross sales, trailed by Solana at $6.1 billion and Bitcoin at $4.9 billion.

Regardless of the slight restoration, 2024’s gross sales volumes have been considerably decrease than the market’s peak years.

NFT gross sales hit $15.7 billion in 2021 and soared to $23.7 billion in 2022, making 2024’s complete a 43.9% and 62.8% decline from these peak durations.

The submit NFT Company Sues Fashion Conglomerate LVMH for Patent Infringement appeared first on Cryptonews.