Crypto trade and custodian Gemini has confidentially filed for an preliminary public providing (IPO), Bloomberg reported, citing individuals aware of the matter.

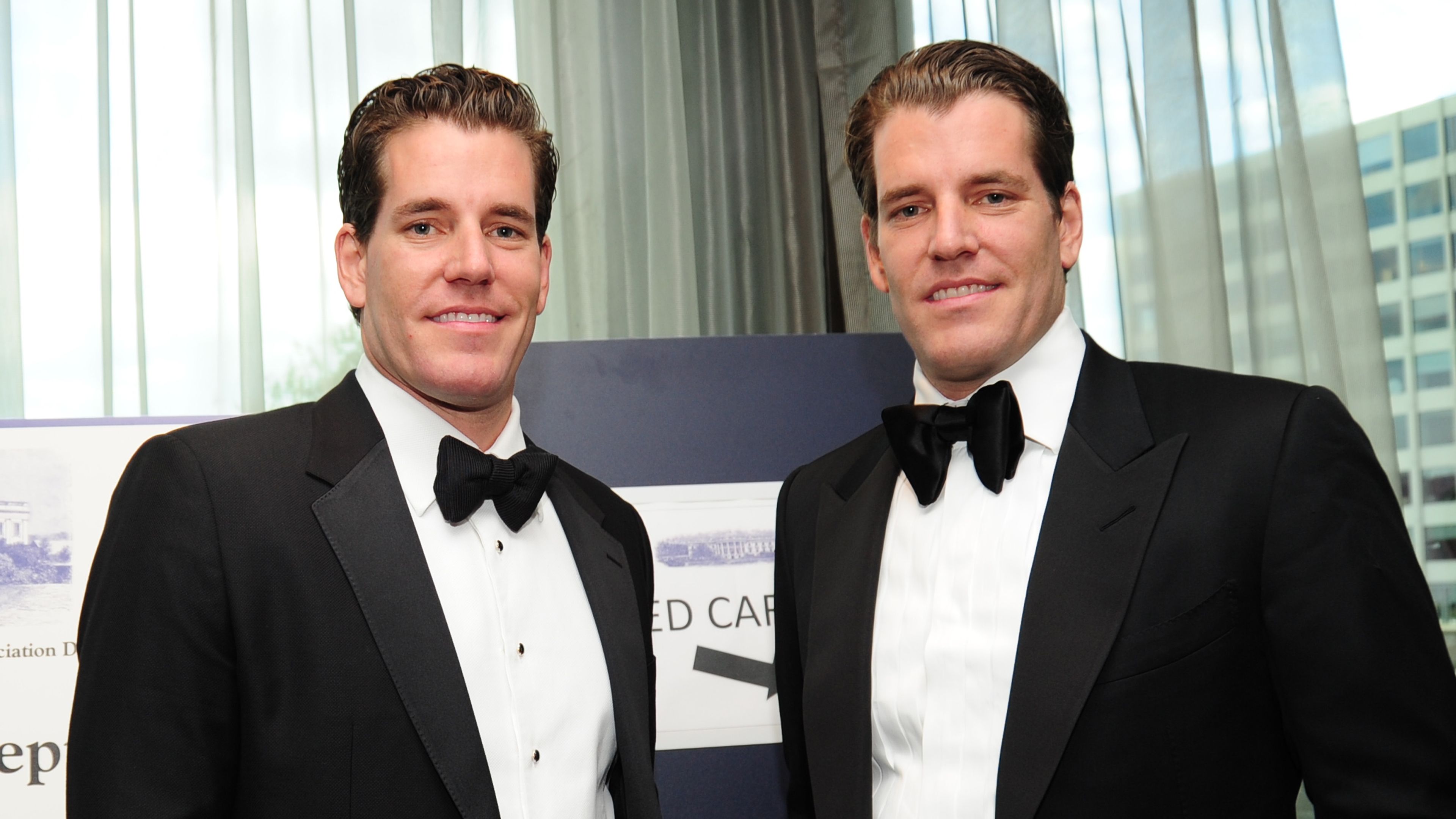

The agency, based by billionaire Cameron and Tyler Winklevoss, is working with Goldman Sachs and Citigroup, the report stated, noting that no closing determination has been made on the itemizing.

The potential IPO comes after the U.S. Securities and Alternate Fee (SEC) ended its investigation into Gemini with out taking motion, in response to a February publish by Cameron Winklevoss. The corporate additionally settled a separate Commodity Futures Buying and selling Fee lawsuit in January for $5 million.

Gemini is amongst a number of crypto corporations lining as much as listing their firms within the U.S. public market after the SEC has been in a full-scale litigation retreat within the first months of the Trump administration.

Simply in the present day, Bloomberg reported that Crypto trade Kraken is contemplating an IPO by the primary quarter of 2026, including to the reviews that corporations similar to Circle, Bullish (dad or mum firm of CoinDesk) and Blockchain.com are additionally queueing up for a U.S. itemizing.