Reinforcing his position as a prime pioneer within the blockchain gaming business – therefore snagging the #1 place amongst our most influential folks within the house roundup – Pixels CEO Luke Barwikowski has launched an in depth 2024 monetary report of the Ronin-based social RPG.

Crunching these numbers, to get a greater overview we’ve labored up the info into the next set of graphs.

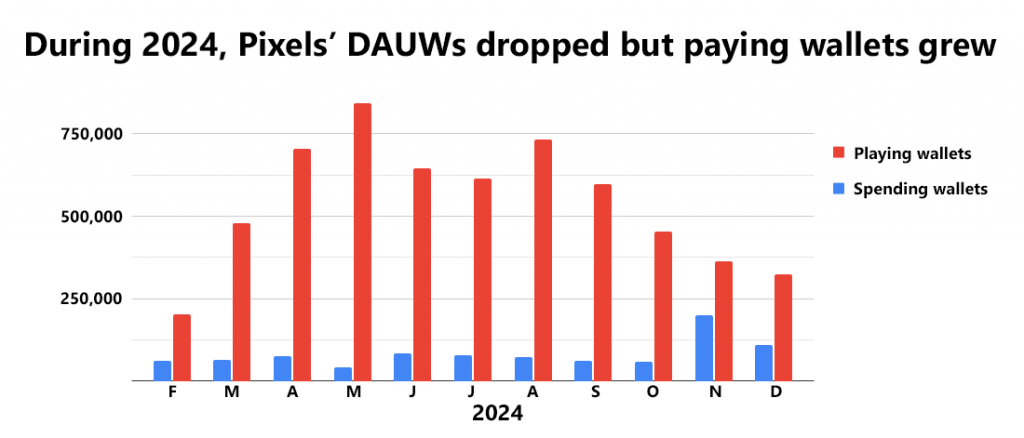

At a excessive degree, the sport has seen two opposite tendencies throughout 2024.

- Its day by day distinctive lively pockets rely (gamers) peaked in Might, dropping steadily — ending 2024 at 283,000 DAUWs — because the staff optimized their play-to-earn rewards technique.

- Nonetheless, the variety of accounts spending PIXEL tokens in-game (paying wallets) grew steadily via 2024 — up 75% evaluating February to December’s complete of 109,000 DAUWs.

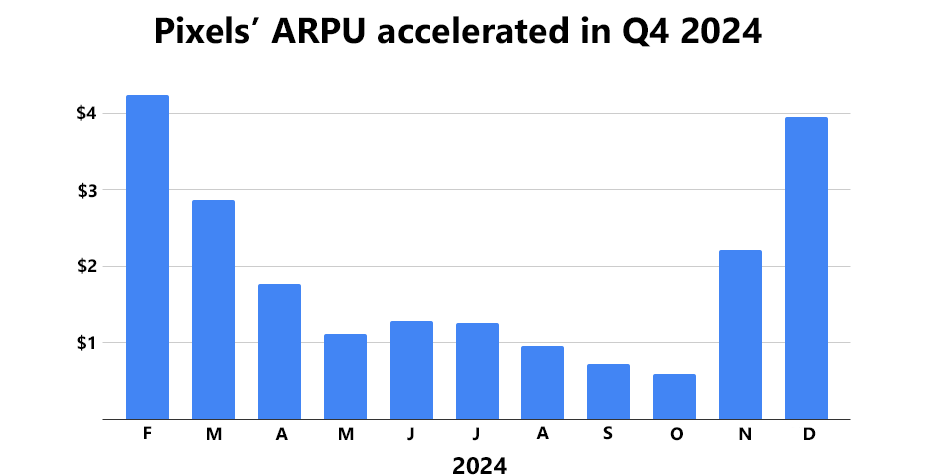

It’s additionally vital to see that the common spend per pockets additionally skilled a pointy enhance in November and December due to new in-game options.

In the meantime, February’s ARPU was so excessive as a result of gamers had been then spending to maximise their preliminary airdrop complete. The PIXEL token went dwell in mid-February.

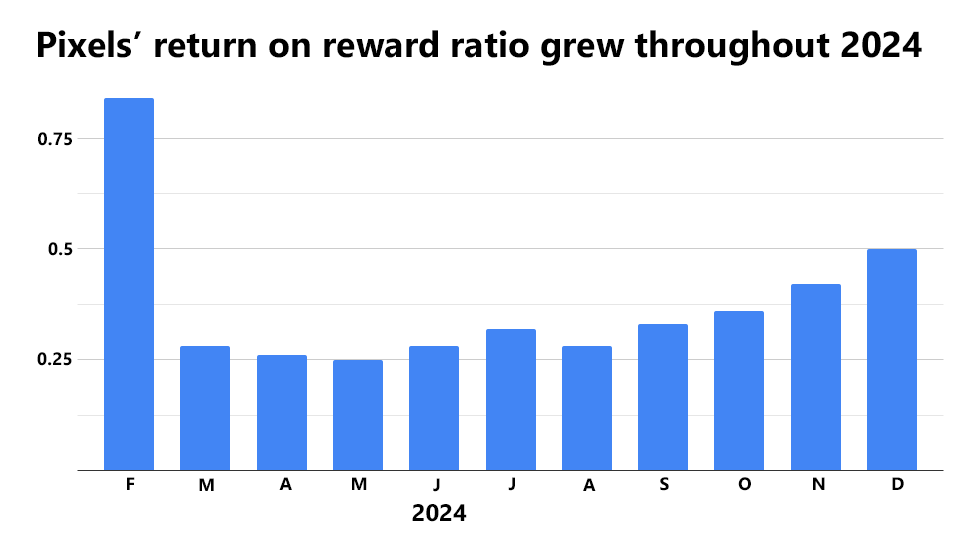

One other crucial KPI is Pixels’ ‘return on rewards’ ratio. That is the proportion of PIXEL given out as rewards throughout a month in comparison with the quantity of PIXEL spent in-game.

Pixels ended 2024 with a reward ratio of 0.5, which means that for each 100 PIXEL given out as rewards, 50 PIXEL had been spent in-game.

Once more, this ratio rose steadily through the 12 months because the staff received higher at optimizing rewards in the direction of gamers who spent their rewards in-game, somewhat than extracting worth from the ecosystem by promoting their tokens off.

Barwikowski is hopeful he and his staff can determine what he calls “web3 fundamentals”, explaining that “The North Star is a new metric we’re pioneering: RORS – Return on Reward Spend. We believe that we can build out a play-to-earn model where rewards generate a positive return on revenue for an ecosystem.”

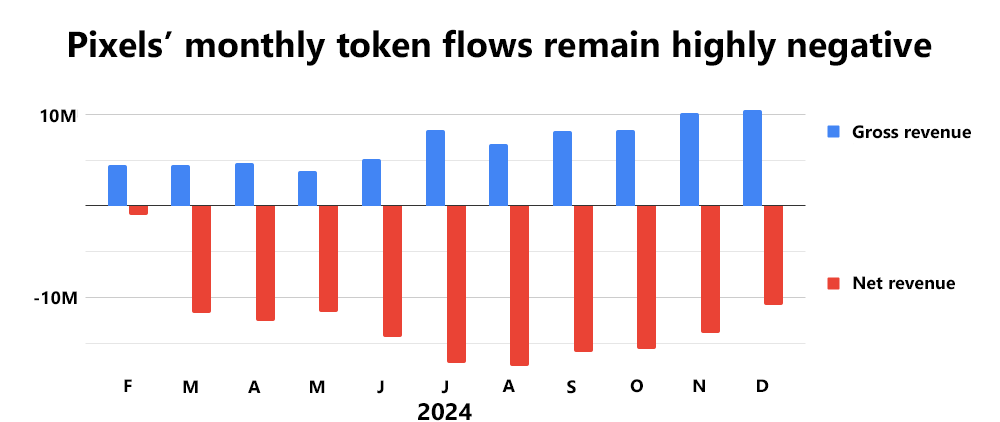

That is excellent news, as is the regular progress of month-to-month income by way of the quantity of PIXEL spent in-game. In December, it hit an all-time-high of 10 million tokens. But web income per thirty days stays considerably damaging, with December’s complete being -10 million tokens, though this was an enchancment from July’s nadir.

Successfully, till the sport’s return on rewards ratio goes larger than 1 — i.e. till web income turns into constructive — the Pixels Basis is being drained of assets.

A sub-1 ratio additionally provides fixed promote strain to the PIXEL token, which is likely one of the causes for the 76% decline within the PIXEL’s token value throughout 2024.

“Once RORS crosses 1 – we’ll feel as if we have made very positive progress on RORS & we’ll have opened up an entirely new model of User Acquisition to the world”, says Barwikowski.

He continues with two hopeful factors. The primary considerations the robust early efficiency of Pixel Dungeons, the primary recreation Pixels has printed which additionally makes use of the PIXEL token. Its opening playtest had a return on rewards ratio that was larger than 1, i.e. extra PIXEL tokens had been spent in-game than given out in rewards.

The opposite is the potential for giant information and AI to allow the higher and earlier focusing on of gamers who spend their rewards in-game somewhat than promoting them.

For additional updates, observe Pixels on X.