The Monetary Stability Oversight Council revealed its 2024 annual report Friday, addressing varied dangers and areas of concern inside the U.S. and world monetary system. Because it has finished for the previous few years, the report highlighted the position of stablecoins and the digital asset sector extra broadly — although it stopped wanting suggesting FSOC would take any concrete steps towards curbing these considerations.

You’re studying State of Crypto, a CoinDesk e-newsletter trying on the intersection of cryptocurrency and authorities. <a href="https://www.coindesk.com/newsletters/state-of-crypto" goal="_blank">Click on right here</a> to enroll in future editions.

'Rising dangers'

The narrative

For one more yr in a row, the Monetary Stability Oversight Council — a gaggle composed of the U.S.'s monetary company heads — warned that unchecked stablecoin development may very well be a problem for the U.S. and world monetary methods in its annual report.

Why it issues

The Monetary Stability Oversight Council is tasked with making certain the U.S.'s monetary stability, and has for years requested Congress to move laws addressing the crypto market. The 2024 report reiterates these considerations.

Breaking it down

For the previous couple of years, FSOC has warned that stablecoins exist exterior any type of federal regulatory framework, and their collective dimension may pose dangers to monetary stability. <a href="https://home.treasury.gov/system/files/261/FSOC2024AnnualReport.pdf" goal="_blank">Friday's report</a> as soon as once more famous that potential danger. On the similar time it additionally urged Congress to move laws addressing stablecoins and market construction, a lot as FSOC's earlier experiences have.

"Stablecoins continue to represent a potential risk to financial stability because they are acutely vulnerable to runs absent appropriate risk management standards," the report stated. "This run risk is amplified by issues related to both market concentration and market opacity."

The report referred to Tether's USDT composing some 70% of the whole world stablecoin market as one difficulty regulators ought to watch.

The shortage of any type of federal regulatory framework is likewise an ongoing concern, the report stated. Some states have frameworks for stablecoins, however that is inadequate for the considerations FSOC has.

"Although a few are subject to state-level supervision requiring regular reporting, many provide limited verifiable information about their holdings and reserve management practices," the report stated.

Although FSOC has warned for the previous few years that it might should take no matter actions it may ought to Congress not act, it's unclear to what extent, if any, it might truly have the option to take action. FSOC can be composed of latest regulators inside the coming months.

"Additionally, many crypto-asset market firms and issuers remain outside of, or in noncompliance with, the U.S. financial regulatory framework," the report stated. "As such, the crypto-asset spot market may continue to experience significant fraud and manipulation. The Council recommends that Congress pass legislation that provides federal financial regulators with explicit rulemaking authority over the spot market for crypto-assets that are not securities."

"We have also been addressing emerging risks from significant technological changes," Treasury Secretary Janet Yellen stated in <a href="https://home.treasury.gov/news/press-releases/jy2737" goal="_blank">a ready assertion</a>. "Digital assets and artificial intelligence bring potential benefits such as efficiencies, but also financial risks, cyber risks, and risks from third-party service providers. The Council continues to call for legislation to create a comprehensive federal prudential framework for stablecoin issuers and for legislation on crypto assets that addresses the risks we have identified."

Tales you’ll have missed

<a href="https://www.coindesk.com/policy/2024/12/04/trump-names-former-sec-commissioner-paul-atkins-as-his-pick-for-chair-of-the-agency" goal="_blank">Trump Names Former SEC Commissioner Paul Atkins as His Choose for Chair of the Company</a>: Paul Atkins, the founder and CEO of Patomak World Companions, an adviser to varied crypto initiatives and a former SEC commissioner, is Donald Trump's decide for chair of the securities regulator.

<a href="https://www.coindesk.com/policy/2024/12/05/trump-names-david-sacks-as-ai-and-crypto-czar" goal="_blank">DYdX Surges 30% as Trump Names David Sacks as 'AI and Crypto Czar'</a>: Trump additionally named David Sacks as his decide for an "AI and crypto czar." Sacks is invested in varied crypto initiatives.

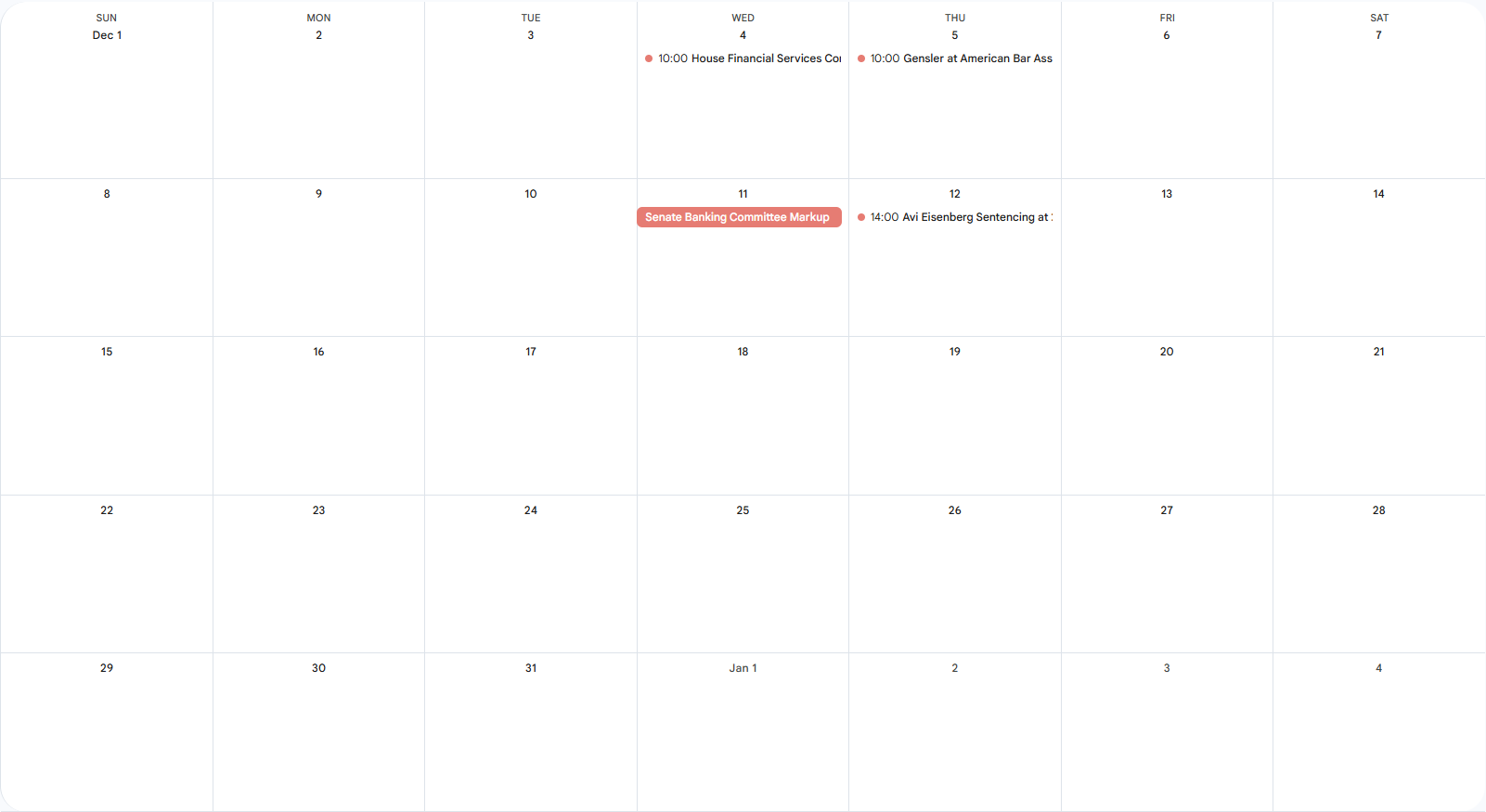

This week

Wednesday

15:00 UTC (10:00 a.m. ET) The Home Monetary Companies Committee held a <a href="https://financialservices.house.gov/calendar/eventsingle.aspx?EventID=409414" goal="_blank">listening to about know-how and finance</a>, serving as a type of swan tune for outgoing committee Chair Patrick McHenry (R-N.C.).

Elsewhere:

(<a href="https://www.bloomberg.com/features/2024-jealousy-list/" goal="_blank">Bloomberg</a>) Bloomberg has an inventory of tales its workforce wished they wrote, and actually what it reveals is there was a number of good journalism this yr.

(<a href="https://www.theverge.com/24312920/martial-law-south-korea-yoon-suk-yeol-protest-dispatch" goal="_blank">The Verge</a>) South Korean President Yoon Suk Yeol declared martial regulation earlier this week. That lasted for a couple of hours, after opposition social gathering lawmakers actually <a href="https://bsky.app/profile/adamjschwarz.bsky.social/post/3lcg46lagl22d" goal="_blank">scaled fences</a> amid <a href="https://x.com/christineahn/status/1863967121597985249" goal="_blank">mass protests</a> in opposition to the declaration to finish the imposition.

Should you’ve acquired ideas or questions on what I ought to talk about subsequent week or every other suggestions you’d wish to share, be happy to electronic mail me at <a href="mailto:nik@coindesk.com" goal="_blank">nik@coindesk.com</a> or discover me on Bluesky <a href="https://bsky.app/profile/nikhileshde.bsky.social" goal="_blank">@nikhileshde.bsky.social</a>.

You may also be part of the group dialog on <a href="https://t.me/CDstateofcrypto" goal="_blank">Telegram</a>.

See ya’ll subsequent week!