When the B20 Token Challenge was launched, anchored on Beeple’s artworks, it instantly resonated with the NFT Neighborhood. In spite of everything, it promised bizarre NFT lovers who might by no means afford a Beeple NFT an opportunity to personal a bit of the upside of the NFT Artwork Revolution by means of fractional NFTs. In case you are bullish on NFTs, how are you going to move up such an opportunity?

B20 token was buying and selling at about $2 a token again in Mid February. Then, the value motion skyrocketed when the hammer went down, marking the sale of Beeple’s Everydays: The First 5000 Days for $69.3 Million. The token recorded an all-time excessive worth of $28. Primarily based on CoinMarketCap, immediately’s price is $1.41. Furthermore, costs have stayed within the one-dollar vary since Mid Might regardless of the general rally within the NFT area.

Naturally, toke holders are beginning to ask questions. Is Beeple’s token worth actually value nothing now? Is the longer term bleak, because the chart implies?

B20 Tokens

Earlier than we bounce into the arguments and evaluation, let’s run down the info first.

Metapurse is a crypto-exclusive fund that focuses on figuring out early-stage tasks and investing in blue-chip digital artwork items. In December, it purchased a set of 20 Beeple NFTs collectively valued at round $2.2 Million. The fund can also be the client of Beeple’s $69.3 Million Paintings.

Metapurse shared possession of its $2.2 Million Beeple Artwork Assortment and the digital museums the place they present the artwork by means of the B20 Token. They organized a public sale of the B20 tokens round January 23. A complete of 1.6 Million tokens had been bought for $0.36, representing 16% of the token provide.

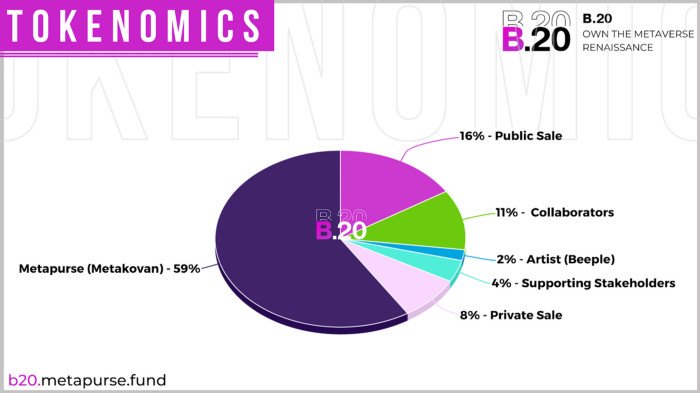

The full provide of B20 Tokens is 10,000,000. Following the tokenomics launched by Metapurse, the mission had a price of $2.7 Million. In the meantime, Metapurse saved 59% of the tokens. Then, 11% went to the collaborators: Metacast, GrowYourBase and Voxel Architects. 8% had been bought on a personal sale, 4% went to stakeholders and at last, 2% went to Beeple.

Given the distribution, it’s clear that true energy lies within the Metapurse Fund. Subsequent query, who’re the house owners of the fund?

Meet MetaKovan and Twobadour

It turned out that two crypto-preneurs are behind the fund – Vignesh Sundaresan, who goes by MetaKovan and Anand Venkateswaran, also referred to as Twobadour.

MetaKovan has been within the crypto area since 2013. He stated that he lived in Canada for a number of years after which left for Singapore in 2017 as a result of crypto laws in North America had been too “unclear.”

He claims that he began with zero capital, so he appeared to the worldwide and open community of Bitcoin to earn some money. Finally, he provided escrow companies and arrange an change in Canada known as Cash-e. The turning level of his wealth technology was when he invested on this planet’s first Preliminary Coin Providing (ICO) of Ethereum.

He parlayed his good points to fund a number of tasks like Polkadot, Tezos, Dfinity, Decentraland, Stream and others. All of which are actually essential gamers within the crypto and NFT area. That is additionally how he received the funds for Metapurse.

Controversies

Impartial blogger Amy Castor suspects that Beeple and MetaKovan are in cahoots to extend the worth of the remainder of Beeple’s Assortment throughout the B20 mission. She made her stance very clear in her article. She defined that the tokenomics awarding 59% to MetaKovan and a couple of% to Beeple is flawed and represents a battle of curiosity.

info, the sale of Beeple’s Everydays: The First 5000 Days certainly positively affected the value of B20 Token. As an instance, the value shot as much as $23 proper after the public sale. This implies the sale of Beeple’s newest NFT boosted the worth of your complete assortment by over 6000%.

Castor additionally claimed that since she printed her article, MetaKovan personally wrote to him and requested her to take it down. She refused however agreed to make edits if he might level out something particular that was incorrect. “So far, he hasn’t,” stated Castor.

Metapurse’s Response

So the million-dollar query that the group and token holders are asking now could be what’s subsequent for the B.20 Challenge? Are the B20 tokens a misplaced case?

On Might 4, Twobadour (aka Anand Venkateswaran), one of many figures behind Metapurse, made public the main points of the promised subsequent chapter within the B.20 story whereas being interviewed by crypto fanatic Alegria on a Twitch stream.

The plan? Metapurse is promising to go ahead with a side of its sensible contract, which can permit management of all of B.20’s property, together with the 20 Beeple artworks the fund bought final December, to be bought with a minimal bid of $58 million.

He’s referring to the “buyout option” within the sensible contract. In keeping with Metapurse’s Medium submit again in January, anybody can attempt to bid for your complete bundle and purchase it out. The sensible contract permits for anybody to come back in with a minimal bid of someplace between $12 mn to $15 mn (TBD) and get the entire NFTs.

Twobadour highlighted that the potential “buyout” of B.20 wouldn’t be a “yard sale” of the property. “B.20 is one single idea and therefore one single NFT,” he defined. “What’s going to be auctioned off when the buyout goes live is the master key of the experience—one single NFT. We call it the ‘B.20 master key.’ And only the owner of this B.20 master key has any right over the B.20 experience.”

He went on to boast that if it hit the goal worth, the “master key” could be “the second most valuable NFT ever.”

The group didn’t actually reply properly to those pronouncements. It sounded extra like a chance than a plan. Furthermore, how can a buyout be potential if MetaKovan holds 69% of the tokens? Doesn’t that make it mathematically inconceivable for somebody to purchase out the B.20 Challenge?

Sadly, there are extra questions at this level than solutions. Cryptocurrencies are infamous for development and droop in 1000’s, so on this case, it seems to be like time would be the final truth-teller.

All funding/monetary opinions expressed by NFTevening.com aren’t suggestions.

This text is academic materials.

As all the time, make your personal analysis prior to creating any sort of funding.