The Stoner Cats NFT mission, co-founded by famend actress Mila Kunis, has encountered buying and selling limitations on among the most distinguished NFT marketplaces, together with OpenSea, Blur, and Rarible. This resolution arrives shortly after america Securities and Change Fee (SEC) introduced expenses towards the creators of the mission, accusing them of the sale of unregistered securities.

Backstory: The Rise of Stoner Cats NFTs

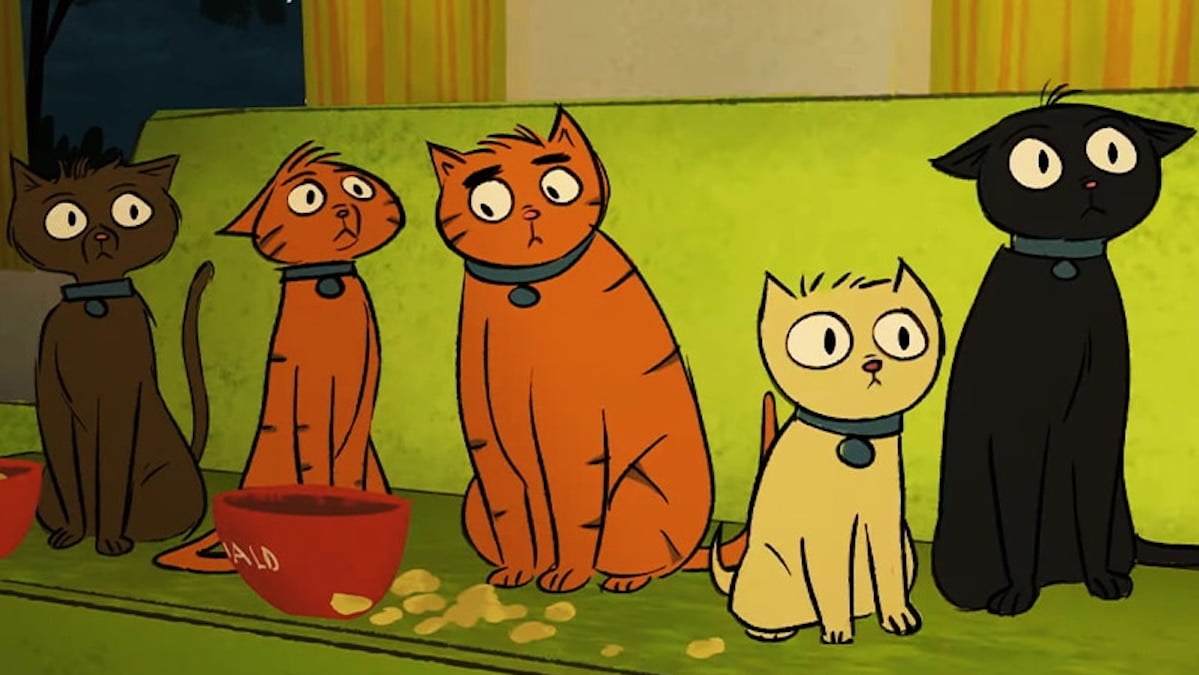

Initially launched to the general public in 2021, the Stoner Cats NFTs, tied to an animated sequence that includes a roster of distinguished celebrities, gained fast traction amongst collectors and traders. These digital property, constructed on the Ethereum blockchain, have been extensively accessible for buying and selling on a wide range of platforms. As of July 2021, the mission had reported spectacular gross sales, with over 10,420 NFT passes bought, resulting in a group of over $8 million from their preliminary sale.

Nevertheless, the current regulatory scrutiny by the SEC has led to a brief setback for the mission. Each OpenSea and Blur, recognizing the authorized implications, have paused lively listings related to Stoner Cats NFTs. Equally, Rarible has opted for a cautious strategy by delisting the mission altogether.

Regardless of these developments, it’s essential to notice that the NFTs haven’t vanished. They proceed to reside securely on the blockchain, remaining within the digital wallets of their respective holders. Platforms similar to LooksRare and X2Y2 have chosen to listing them, enabling present house owners to commerce them if desired.

SEC’s Involvement and Its Impression on the Market

The SEC’s intervention on this matter may be perceived as an indication of the regulatory physique’s rising curiosity in overseeing the quickly evolving NFT house. Put up the allegations, the creators of Stoner Cats opted for a settlement. They concurred to pay a civil fantastic of $1 million, a considerable sum that can be directed in direction of establishing a Honest Fund. This fund is meant to facilitate the reimbursement of traders.

An attention-grabbing market dynamic emerged following the SEC’s announcement. Whereas some might need anticipated the worth of Stoner Cats NFTs to plummet given the authorized quandary, the other transpired. The market witnessed an uptick within the gross sales quantity of those NFTs. Furthermore, the costs of those digital property additionally noticed a noteworthy rise.

The unfolding of those occasions underscores the significance of regulatory readability within the ever-evolving area of NFTs. Because the house continues to broaden and entice substantial investments, making certain investor safety and compliance with established securities legal guidelines turns into paramount.

Conclusion

The Stoner Cats state of affairs serves as a pivotal case research, highlighting the complexities and nuances related to the NFT market. Whereas the mission has confronted challenges, its resilience out there submit the SEC’s intervention is indicative of the sturdy demand and curiosity in NFTs amongst digital collectors and traders alike.