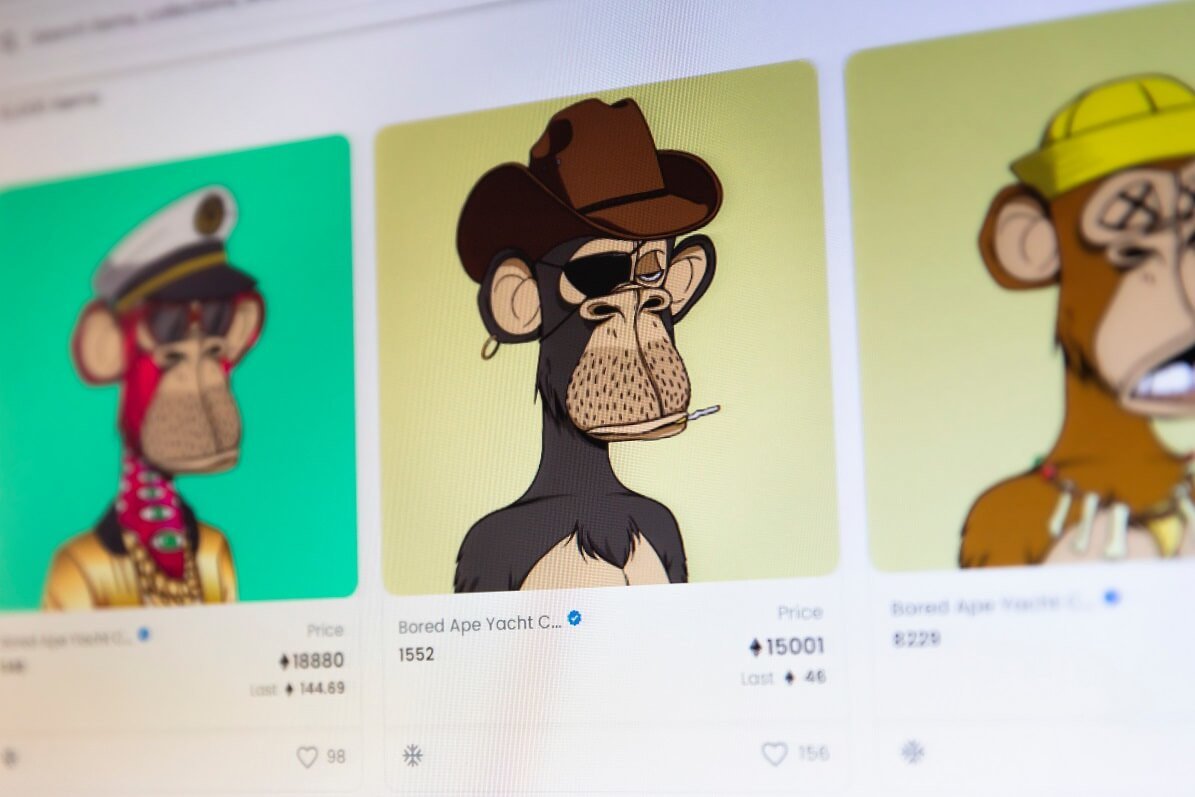

Yuga Labs, the entity behind the favored NFT assortment Bored Ape Yacht Membership (BAYC), is about to halt help for OpenSea attributable to a change within the platform’s royalty mannequin.

In a Saturday tweet, Yuga Labs introduced that it plans to wind down help for OpenSea following the upcoming removing of Operator Filter, an on-chain royalty enforcement software.

“Yuga Labs will begin the process of sunsetting support for OpenSea’s SeaPort for all upgradable contracts and any new collections, with the aim of this being complete in February 2024 in tandem with OpenSea’s approach,” the announcement reads.

OpenSea launched Operator Filter in November final 12 months as a method for creators to make sure that secondary gross sales of their NFTs solely happen on marketplaces that implement creator royalties.

This function successfully filtered out platforms like Blur from collaborating in such gross sales.

Nonetheless, OpenSea not too long ago introduced its resolution to “sunset” the software by the tip of August.

The platform cited an absence of adoption throughout the ecosystem, loopholes that allowed platforms to bypass the software, and pushback from creators as the explanations behind this transfer.

In response to OpenSea’s resolution, Yuga Labs took to Twitter to share the corporate’s plan to regularly wind down its use of OpenSea’s Seaport market good contract.

The corporate reiterated its dedication to defending creator royalties, making certain that creators are adequately compensated for his or her work.

BAYC Group Helps Yuga Labs Choice

The announcement from Yuga Labs was met with a optimistic response from the BAYC group, in addition to content material creators and founders of different notable NFT tasks like EllioTrades and Alex Becker.

Dotta, CEO and co-founder of the Forgotten Runes Wizards Cult NFT undertaking, expressed help for Yuga Labs’ resolution, highlighting the ability of creators to shift in the direction of marketplaces that prioritize royalty funds.

“The creators have enough power in aggregate to move to royalty paying marketplaces,” they mentioned in a latest tweet. “Yuga leading the charge is the spark that was needed.”

Likewise, Luca Netz, the CEO of the Pudgy Penguins NFT undertaking, appeared to point that his undertaking would possibly comply with an analogous course as Yuga Labs.

The difficulty of creator royalties has change into a divisive matter throughout the NFT group over the previous 12 months.

Initially, imposing creator royalties was the norm in the course of the NFT increase in 2021.

Nonetheless, marketplaces like Blur entered the scene in October 2022, providing zero buying and selling charges and an optionally available creator royalty cost mannequin.

This disrupted the market and led to a lower in buying and selling charges and royalty percentages as platforms competed for customers.

At the moment, there’s a clear divide throughout the NFT group between those that desire the cheaper buying and selling mannequin provided by platforms like Blur and advocate for different strategies of compensating creators, and people who strongly help the cost of royalties.