Within the ongoing authorized confrontation between cryptocurrency trade large Coinbase and the U.S. Securities and Trade Fee (SEC), District Decide Katherine Polka Failla has raised eyebrows within the crypto neighborhood along with her probing questions and feedback associated to the SEC’s 2021 approval of Coinbase’s S-1 submitting. The related courtroom exchanges unfolded throughout a pre-motion listening to on July 13 and centered on Coinbase’s preliminary public providing (IPO) in 2021.

Coinbase’s IPO, which required an efficient S-1 submitting with the SEC, allowed the corporate’s shares to be publicly traded for the primary time. S-1 filings are the kind of registration required by the SEC for brand spanking new securities for public, U.S.-based firms. In June, the SEC filed a civil lawsuit in opposition to Coinbase alleging securities regulation violations, although it raised no considerations on the time of the IPO, a distinction Decide Failla known as out within the case’s listening to held final week.

Shifting the authorized goalposts

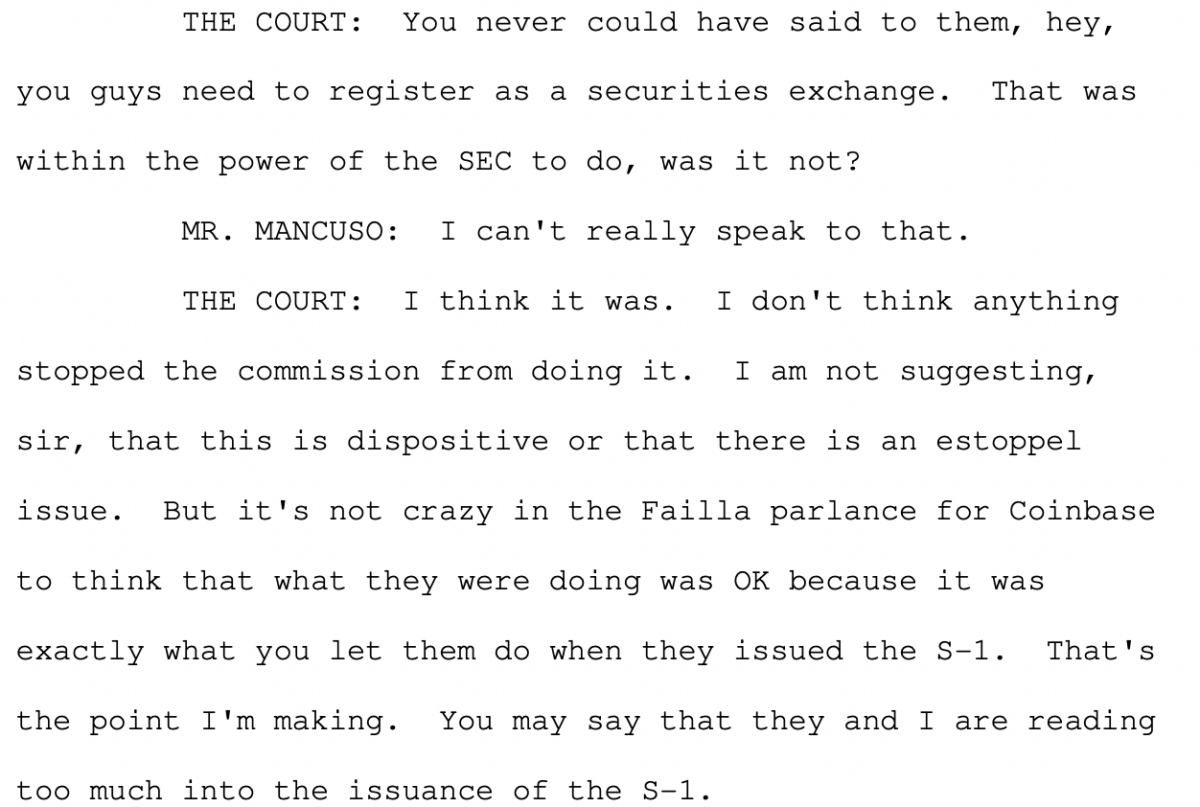

In court docket paperwork revealing the dialog that befell in the course of the listening to, Decide Failla conjectured that Coinbase could have inferred their actions as permissible from the SEC’s lack of opposition in the course of the S-1 submitting course of.

The SEC’s authorized counsel was fast to make clear, arguing that the acceptance of the S-1 submitting doesn’t indicate approval of the corporate’s underlying enterprise mannequin or operations:

“Simply because the SEC allows a company to go public does not mean that the SEC is blessing the underlying business, or the underlying business structure, or saying that the underlying business structure is not in violation of the law,” they stated.

The SEC’s counsel couldn’t present proof to verify that the regulatory physique had examined particular property listed on Coinbase’s platform or assured the cryptocurrency trade that they wouldn’t be deemed safety in a while. This discrepancy within the SEC’s actions throughout Coinbase’s IPO course of attracted Decide Failla’s scrutiny, who additional steered that the SEC’s place on the S-1 submitting required skepticism.

Within the court docket’s view, the SEC could have executed properly to have carried out its due diligence into the corporate’s enterprise practices in the course of the analysis of Coinbase’s S-1. This, Decide Failla believes, might have alerted Coinbase to potential future issues of their enterprise operations. Regardless that she didn’t anticipate the SEC to be “omniscient,” she expressed a perception that they need to have had some foresight into potential conflicts between Coinbase’s enterprise and securities legal guidelines.

A change within the regulatory wind?

This distinction was one which Steven Peikin, a part of Coinbase’s authorized group and a former co-director of the SEC’s enforcement division, additionally pressed. Peikin identified the SEC’s historic apply of declining to evaluation registrations from sectors like hashish and betting. Reinforcing Decide Failla’s skepticism, Peikin argued that the SEC’s authorization of Coinbase’s S-1 carried extra authorized weight than the regulatory physique claimed.

Whereas the continuing represents a small portion of the SEC’s lawsuit in opposition to the trade, there have been few situations of judicial representatives both empathizing with the arguments introduced by crypto exchanges or ruling of their favor. Some within the Web3 neighborhood are desirous to see this as an indication that the place of Web3-native firms working within the NFT and crypto sphere are much less invalid than the SEC has made them out to be in its regulatory strategy.

Editor’s notice: This text was written by an nft now employees member in collaboration with OpenAI’s GPT-4.