Ripple’s Chief Authorized Officer, Stuart Alderoty, has referred to as for an investigation into former U.S. Securities and Trade Fee (SEC) director Invoice Hinman. The decision comes within the wake of the court-ordered launch of a trove of paperwork by the SEC, which has been embroiled in a authorized dispute with Ripple since 2020.

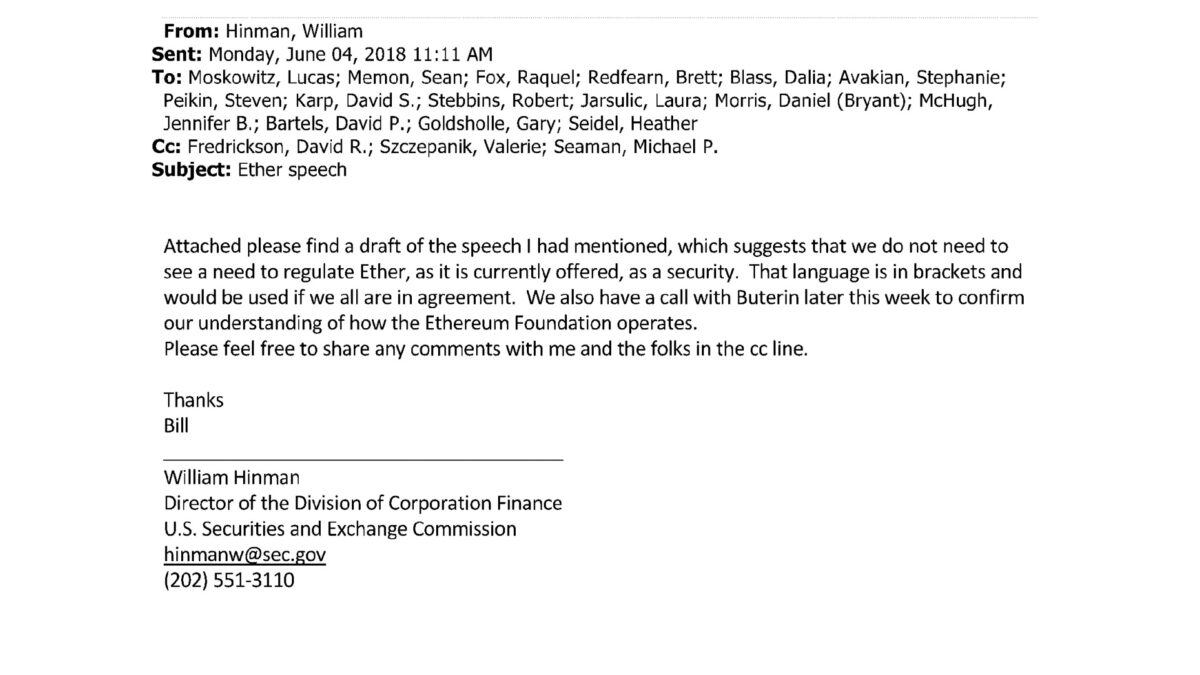

The paperwork, which have been lately unsealed by a choose’s order, reveal conflicting ideas and opinions inside the SEC concerning the regulation of the crypto business. They largely pertain to a speech delivered by Hinman in June of 2018, by which he acknowledged that Ethereum (ETH) shouldn’t be thought-about a safety because it was “sufficiently decentralized.”

13/An investigation should be carried out to know what or who influenced Hinman, why conflicts (or, on the very least, appearances of conflicts) have been ignored, and why the SEC touted the speech realizing that it could create “greater confusion.”

— Stuart Alderoty (@s_alderoty) June 13, 2023

Nevertheless, Web3 lovers — together with a number of figures concerned in ongoing instances with the SEC — view this assertion as being at odds with the regulatory physique’s later choice to sue Ripple Labs for allegedly promoting $1.3 billion value of XRP as an unregistered safety. The paperwork have precipitated the broader crypto business to accuse the SEC of arbitrarily making use of securities legal guidelines to a spread of digital tokens, displaying a marked lack of inner cohesion towards blockchain-enabled applied sciences and general being out of contact and unfit to adequately regulate the business.

Difficult the SEC’s regulatory legitimacy

In a Twitter thread outlining his ideas on the matter, Alderoty claims that Hinman “invented factors” that needs to be considered when figuring out what “sufficiently decentralized” really means. He additionally urged the SEC to take away the speech from its web site and provoke an investigation into the previous director.

“An investigation must be conducted to understand what or who influenced Hinman, why conflicts (or, at the very least, appearances of conflicts) were ignored, and why the SEC touted the speech knowing that it would create ‘greater confusion,’” Alderoty wrote.

The Ripple authorized chief additionally argued that the unsealed paperwork, which embody emails and different digital paperwork, present dissent amongst SEC officers concerning sure elements of Hinman’s speech and that the director ignored their considerations. Alderoty cited parts of the paperwork the place the physique’s Head of Buying and selling and Markets expressed considerations that the in depth listing of things in Hinman’s speech may result in larger confusion about what constitutes a safety.

The importance of the Howey Check

One of many causes the Web3 group is up in arms concerning the paperwork is that Hinman’s feedback, together with these made by different SEC employees members, sit in stark distinction to these of SEC Chair Gary Gensler, who has been vocal about how the group depends on the Howey check to think about the authorized categorization of crypto tokens. Whereas Gensler has mentioned that the SEC considers “most crypto tokens” as funding contracts below the Howey Check, claiming that the authorized framework already exists with which to think about cryptocurrencies, these new paperwork reveal figures inside the SEC’s personal partitions should not united on this considering.

That such dissent and dialogue exists even among the many SEC’s personal employees is probably unsurprising; even SEC Commissioner Hester Peirce has lengthy criticized Gensler’s regulation-by-enforcement strategy to the business.

14/ And at last, Hinman’s speech ought to by no means once more be invoked in any critical dialogue about whether or not a token is or is just not a safety. Unelected bureaucrats should faithfully apply the regulation inside the constraints of their jurisdiction. They will’t – as Hinman tried – create new regulation.

— Stuart Alderoty (@s_alderoty) June 13, 2023

Alderoty is way from the one voice essential of the Gensler-led physique in what’s more and more beginning to seem like an all-out regulatory conflict on crypto; on June 12, GOP lawmakers launched the SEC Stabilization Act, which requires the removing of Gensler from the SEC.

Because the SEC continues to ramp up authorized efforts with the largest cryptocurrency exchanges in existence, the Ripple case and the following name for an investigation into Hinman’s actions spotlight the continuing debate and confusion surrounding the regulation of the crypto business.

The talk is way from tutorial; Crypto.com lately introduced it could be closing down its U.S. institutional providers, and the enterprise capital large Andreessen Horowitz (a16z) has revealed it will likely be opening a crypto-focused workplace within the U.Okay. within the coming months. How these developments ultimately play out is prone to have a big affect on the way forward for the business.

Editor’s be aware: This text was written by an nft now employees member in collaboration with OpenAI’s GPT-4.