OpenSea has a safety and fraud downside and if one account holder on the NFT market is correct, it’s negligent in defending its clients and responsible of extortion.

As distinguished NFT creator, collector and enterprise capitalist Kevin Rose would little question attest, theft within the NFT house is a significant issue. He misplaced part of his private assortment valued at $1.1 million in a current phishing assault, though that was nothing to do with OpenSea.

Robert Acres, as we element beneath, additionally fell sufferer to an NFT phishing assault. Not as high-profile a person of OpenSea as Rose, Acres had two NFTs stolen in a phishing assault.

He alleges that removed from promptly attempting to assist him retrieve his property and stop resale by the thieves, as OpenSea is reported to have accomplished with Rose, the main NFT market ended up locking Acres out of his account for 3 months.

Throughout that point Acres alleges he suffered giant losses on the 58 NFTs in his account as a result of he was unable to commerce them.

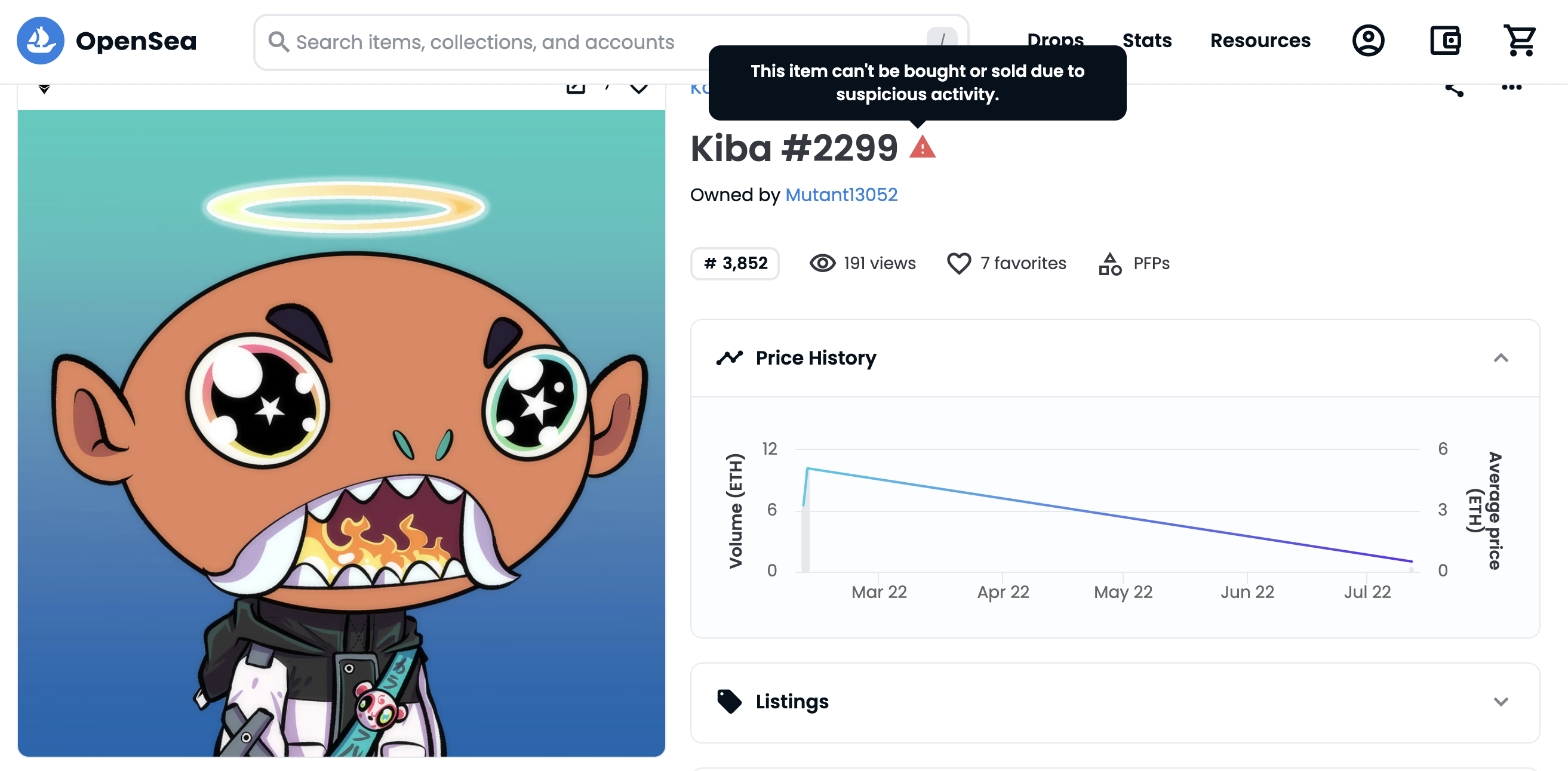

The 2 now blacklisted stolen NFTs may be seen listed on OpenSea, with a warning that the gadgets can’t be purchased or bought as a result of suspicious exercise:

https://opensea.io/assets/ethereum/0xd2f668a8461d6761115daf8aeb3cdf5f40c532c6/2299

https://opensea.io/assets/ethereum/0x4db1f25d3d98600140dfc18deb7515be5bd293af/5297

Acres’s stolen NFTs had been bought by the thief for 0.5 and 0.7 WETH.

Nonetheless, Acres estimates his loss ensuing from not with the ability to commerce his remaining NFTs on OpenSea at as a lot as $500,000 and is suing the NFT market – OpenSea is a buying and selling identify of Ozone Networks Inc – to make good these losses.

He has employed the companies of Traverse Authorized, with managing accomplice and trial lawyer specializing in blockchain and web3, Enrico Schaefer, heading up the crew.

Picture caption: one of many stolen NFTs: https://opensea.io/assets/ethereum/0xd2f668a8461d6761115daf8aeb3cdf5f40c532c6/2299

OpenSea person says he was locked out of his account after complaining

Acres alleges that when he complained concerning the sluggish response by OpenSea to the theft, it was then that {the marketplace} locked him out of his account.

In line with the timestamped help communications with OpenSea seen by Cryptonews, dated July twelfth 2021, the day the theft passed off, Acres knowledgeable OpenSea of the theft previous to the sale of the stolen NFTs on {the marketplace}.

The transaction hash of the theft is proven on etherscan and timestamped at 01:38 PM UTC: https://etherscan.io/tx/0xa6bc538181d79b342cd69042eac74b9a64a1aeb99ed05d98d3f5c09a6f7bf59d

The sale passed off one hour later at 02:38 PM UTC: https://etherscan.io/tx/0xd2327c65e66d0ac94282580f0a8d64d1cd155faa53d7613565d55c6ed9862b25

The e-mail reporting the theft to OpenSea help is timestamped at 02:11 PM UTC.

The tx hashes present that there was half an hour between OpenSea being alerted to the theft and the following sale on {the marketplace}.

Admittedly it might be argued that the half-hour window didn’t give OpenSea a lot time to react, but when this was legacy finance, the place automated surveillance techniques are in operation, processes can be in place to shortly droop suspect exercise.

However, given its lack of motion to forestall the resale, it may be cheap to conclude that OpenSea doesn’t seem to have had sufficiently sturdy techniques in place to have the ability to reply to such alerts from customers in a well timed vogue.

OpenSea’s preliminary response seems to be intentionally disingenuous

Partly, in its solely public assertion made on the matter thus far, an OpenSea spokesperson, acknowledged: “The theft in question took place outside of OpenSea and the items were sold before OpenSea became aware of the reported theft. Soon after we were notified and became aware, we disabled the items and the user’s account has since been unlocked.”

The primary clause of the primary sentence is right – it was a phishing assault that had nothing to do with OpenSea. However, if Mr Acres is right, the remainder of that snippet from the assertion is incorrect. OpenSea, as proven above, was knowledgeable of the theft earlier than the sale passed off.

The second sentence is disingenuous to say the least because it might be taken to deduce that the person’s account was unlocked quickly after the 2 NFTs had been disabled, which was not the case – Acres’s account was locked for 3 and half months.

Certainly, it seems it was when Acres took difficulty with OpenSea’s failure to forestall the sale of the stolen NFTs, that his account was locked.

In an e-mail to Cryptonews.com, Acres writes:

“Frustrated and believing OS bore some responsibility for what had occurred, I noted that OS should be liable for monetary damages. In response, OS locked my account without notice, request, or permission.”

Acres goes on to state that “OS demanded that I swear under oath that my wallet has not been compromised (meaning OS would not be liable)”.

In line with Acres’s account, when he refused to adjust to the alleged calls for from OpenSea, he was locked out of his account. Acres additional claims that OpenSea, because of the lock out, prevented him from buying and selling his 58 NFTs on the OpenSea market.

OpenSea person claims the NFT market “can seize your NFT assets”

Acres writes in his e-mail to Cryptonews.com: “OS represents that its users’ NFTs are not in the custody of OpenSea. Yet, most OpenSea members are unaware that OS can seize your NFT assets and preclude you from moving or trading your NFTs for days, weeks, months, or presumably forever, even if you did nothing wrong.”

The OpenSea assist middle web page, clearly states the alternative to be the case:

“While we can prevent your items from being bought or sold using OpenSea’s services, your items remain on the blockchain and are not in the custody of OpenSea.”

OpenSea wouldn’t in fact be capable to stop a person of the platform from buying and selling their NFTs on a competing market. Meaning it might not be the case that, strictly talking, OpenSea “can seize your NFTs”, as Acres claims

Nonetheless, in apply, many of the liquidity accessible within the NFT market is to be discovered on OpenSea. Right here we see writ giant the limitations of crypto decentralization in apply versus its theoretical meant outcomes.

In a protection of the accusation he ranges towards OpenSea concerning the lock on his account, Acres instructed Cryptonews: “Once your wallet is ‘locked’ or ‘blocked’ all the items in your wallet are flagged as suspicious and thus no matter what wallet they are transferred to they will never be able to trade on OpenSea until they remove the flag against your account.

“Currently, OpenSea commands over 60% of all NFT trading volume and back when this incident happened it was far greater.

“The trading volume left being split by competitors means that you are not able to get the most competitive pricing and thus again builds into the financial losses being accrued by myself for a wallet lock that was placed on me against my will.

“Most individuals that trade on any OS competitor marketplace often end up using OS as the resale market after they purchase on a competitor’s marketplace.

“So again, in this case, all my NFTs would carry this ‘suspicious’ tag when shown on [the] OS marketplace[;] the new buyer also cannot sell it and thus when they are doing their due diligence during the buying process they wouldn’t purchase them as re-sale options would be limited.”

How is that line of argument more likely to play out in a courtroom of legislation?

OpenSea stands accused of tried extortion

We put the identical query, concerning the complainant being free to commerce his NFTs elsewhere, to Acres’s lead lawyer, Enrico Schaefer, managing accomplice at Traverse Authorized.

This was his response.

“OpenSea acquired Mr. Acres’ assets by assuming control of his account, which constitutes the tort of conversion [lawyer-speak for a form of theft]. This gives individuals who are the victims of theft the legal right to take legal action to recover their damages.

“In essence, conversion provides one with the ability to file a lawsuit to obtain damages for the conversion over their property. Conversion occurs when a person, with the intention and without proper authorization, takes control of another person’s property or funds, thereby limiting their ability to access it.

“The control does not need to be exclusive. The lack of response from OpenSea and the attempted extortion to unlock the account must have been a surprise and a cause for concern, as it would be for anyone in a similar situation.”

Why didn’t OpenSea reply in a well timed vogue as soon as alerted to the NFT theft?

Moreover, Traverse Authorized on behalf of Acres claims that OpenSeas had three hours to behave earlier than the sale of the stolen NFTs passed off on its platform.

“If OpenSea had not waited over three hours to actively engage, the NFT could have been locked and potentially returned to his wallet,” writes Traverse Authorized.

In truth the lapse of time between being alerted to the theft and their subsequent sale was truly solely half an hour, as we talked about earlier, based on Cryptonews evaluation.

However, after all the well-documented points on the location confronted by its customers, from insider-dealing to theft, OpenSea ought to certainly by now have applied techniques and processes, automated and human, to instantly pause suspicious exercise when it’s flagged.

Leaving the timings apart, certainly OpenSea would be capable to defend themselves on the idea that Acres would have been free to commerce his 58 NFTs listed on OpenSea at one other venue?

“This matter is best directed to Robbie, who experienced the situation firsthand,” wrote Schaefer in an e-mail to Cryptonews.

He continued: “However, I have previously represented clients facing similar issues. The assertion that ‘a lesser platform with fewer buyers and sellers’ could have been used instead is not a valid excuse for OpenSea to shirk its responsibilities to its platform members.

“OpenSea is the preferred platform for individuals seeking to maximize demand and pricing pressure in the market. Using a platform with a significantly lower sales volume would have resulted in a liquidation sale rather than substantive trading activity.”

The three questions for OpenSea that stay unanswered

What does OpenSea should say about all this, past their preliminary assertion shared with media retailers?

We despatched OpenSea the next questions:

- Why was Mr Acres locked out of his account towards his will?

- Why was Mr Acres required to perjure himself, as is alleged, as a way to get his account unlocked?

- Will Mr Acres obtain compensation for losses allegedly incurred within the time that he was unable to entry his account?

Per week later and we’re nonetheless but to listen to again from OpenSea.

It’s certainly the peak of irony {that a} market that trades merchandise based mostly on a know-how whose use worth is grounded in its capacity to securely assign distinctive identities to digital and non-digital property and different property, will not be capable of stop the proliferation of fraudulent listings and the sale of mentioned stolen property.

Does OpenSea put the amassing of buying and selling charges income above the pursuits of its customers?

We gave Acres the ultimate phrase. On phone, in a dialog wherein he agreed that the right timing is half an hour as regards the report of the theft and the sale of the stolen property, he however insisted: “The major [of his complaint] part is the fact that they locked my account for three and a half months and asked me to perjure myself.

“I completely understand that it is a phishing scam and that acting within 45 minutes to an hour of me being notified myself and then notifying OpenSea – and that half-an-hour stretch in terms of me notifying them that it has been stolen and hoping that they could take some sort of action – is pretty slim, I do completely adhere to that.

“But everything that follows on from that transaction is negligence 101.”

Have you ever had your account locked by OpenSea previously; been the sufferer of assaults by fraudsters however discovered OpenSea sluggish to assist; or are a creator of NFTs listed on OpenSea battling scammers persistently posting fraudulent variations of your merchandise? In that case, get in contact with Cryptonews at [email protected].