Crypto banking exercise was paused or prevented by the Federal Deposit Insurance coverage Corp. at a lot of U.S. banks in 2022, in response to communications pried free by a analysis agency employed by Coinbase Inc. (COIN).

Coinbase’s employed assist, Historical past Associates Inc., had taken the FDIC and the Securities and Alternate Fee to court docket in June and at last received entry to sure inside FDIC communications. The heavily-redacted paperwork emerged on Friday, displaying the banking regulator slamming the brakes on lenders providing or contemplating services within the digital belongings sector.

“We respectfully ask that you pause all crypto asset-related activity,” the regulator wrote in one of many 23 letters shared by the crypto trade. “The FDIC will notify all FDIC-supervised banks at a later date when a determination has been made on the supervisory expectations for engaging in crypto asset-related activity.”

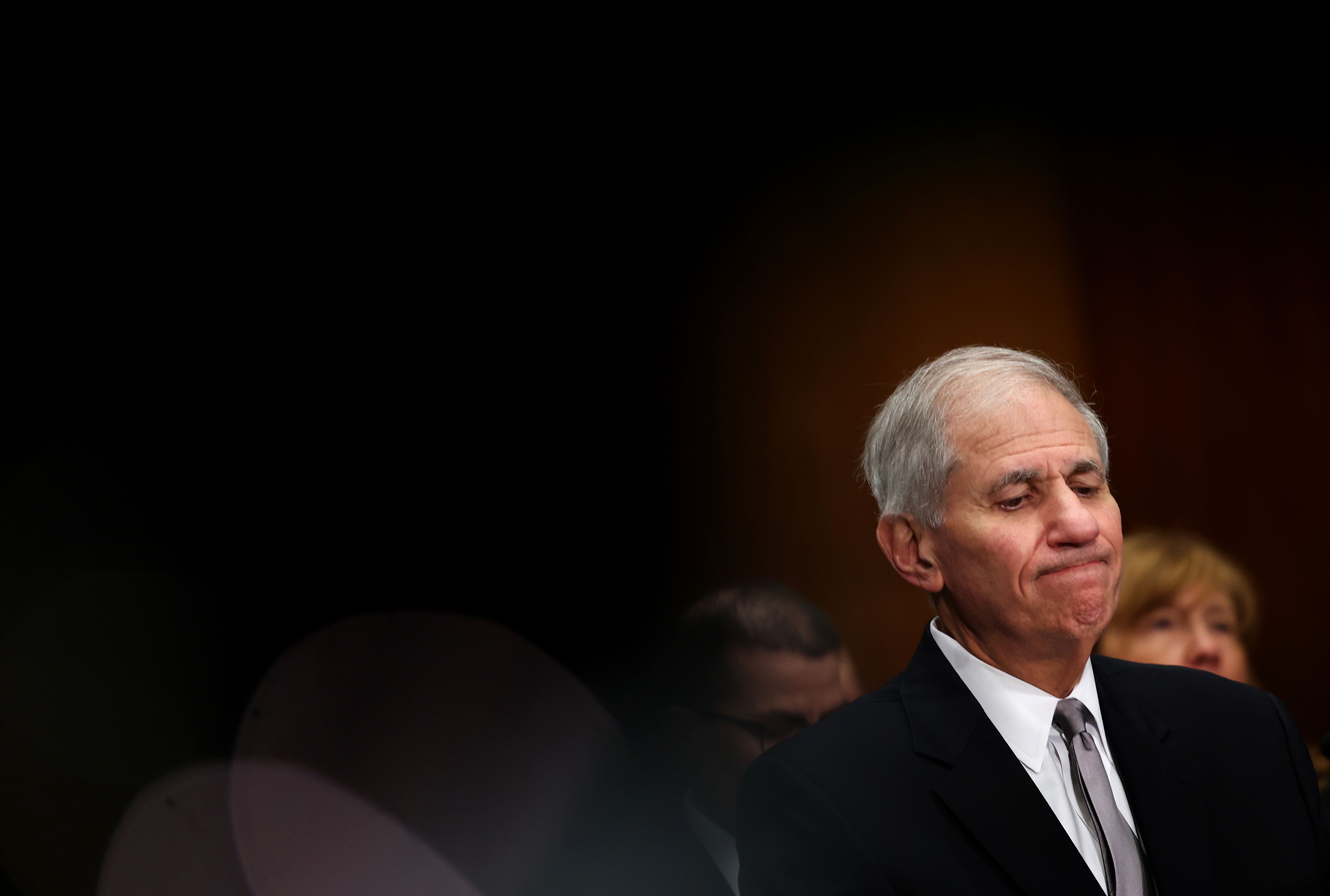

The trade has lengthy complained that it has been underneath a banking disaster by which firms and main crypto figures are blocked from U.S. financial institution providers. Coinbase Chief Authorized Officer Paul Grewal argued that these letters symbolize onerous proof that crypto companies had been systematically walled off from banking by the regulator.

“The letters show that this was no conspiracy theory at all, that this was not just rank speculation or the musings of a paranoid industry,” Grewal mentioned in an interview with CoinDesk. “There was a concerted plan on the part of the FDIC that they carried out — without any reluctance — to deny banking services to a legal American industry. That should give everyone great pause.”

Learn Extra: Citibank Debanked Ripple’s Brad Garlinghouse As a result of Crypto, Exec Says

Although a lot of the textual content of the FDIC letters is blacked out and the precise establishments aren’t recognized, the communications dated all through 2022 make it clear that the varied crypto actions bankers submitted for FDIC approval would not be shifting ahead till the banks might reply questions on how they might meet compliance calls for, which did not but appear fleshed out. In some circumstances, the exercise was stopped earlier than it began, and in others, the company appeared to warning in opposition to any additional enlargement or was asking a financial institution to halt a line of enterprise till the company might end reviewing the agency’s request.

“We expect you to satisfactorily address these and any subsequent questions (in advance of implementation) to ensure the bank of operating in a safe and sound manner,” learn a typical instance.

A few of the confidential letters included dozens of extremely complicated and demanding questions posed to the banks. However lots of the paperwork additionally indicated the company wasn’t but positive what regulatory filings would even be required earlier than it might green-light crypto enterprise.

Whereas the three main banking regulators within the U.S. — additionally together with the Federal Reserve and Office of the Comptroller of the Foreign money — have issued some broad cautionary steerage about crypto, the companies have not instituted a proper algorithm regulating the sector.

An FDIC spokesperson declined to touch upon the discharge of the letters on Friday.

Grewal mentioned the subsequent step in federal court docket shall be to request that the letters be cleared of the redactions, revealing the establishments, the providers they sought to supply and all of the questions they had been requested. That may get to the “why” behind the FDIC’s stance, he mentioned.

“Even after federal courts ordered the FDIC to produce this information over and over again, they continue to drag their feet, and we think it’s time that they stop,” Grewal mentioned.

The debanking marketing campaign has been identified within the trade as Operation Chokepoint 2.0 after a earlier authorities effort to sever controversial however authorized companies from banking. The subject arose once more in Congress this week throughout a listening to of the Home Monetary Providers Committee, the place crypto enterprise leaders testified that their firms had been lower off from monetary providers.

“We’ve also been debanked,” mentioned Nathan McCauley, the CEO of Anchorage Digital, a financial institution federally chartered within the U.S. by the OCC. “It’s particularly surprising, because we ourselves are a national bank.”

UPDATE (December 6, 2024, 14:42 UTC): Updates with FDIC’s response.